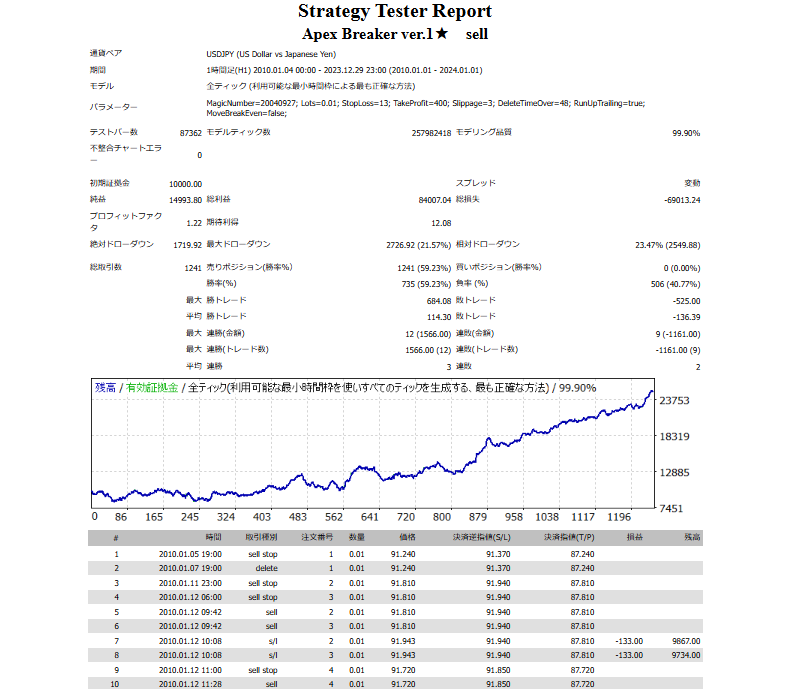

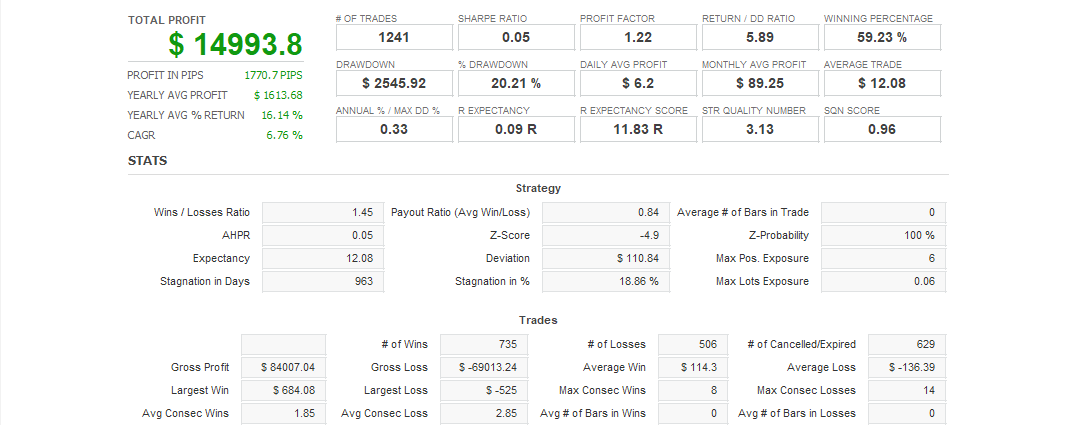

A method of waiting for a breakpoint to occur as a stop-limit signal by using a pending order, and then riding the short-term wave using the breakpoint as a starting point.

Unfilled orders stored as stop-loss signals during the waiting period will be carried over until the delete time, so all stock positions that have not been deleted at the time the breakpoint is reached will be executed together.

In other words, the basic holding is one position, but since the number of stop-loss stocks changes depending on the delete time, the stocks may be released all at once and executed.

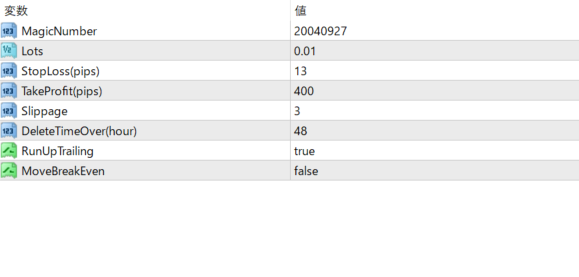

*Delete Time: If a pre-order is not executed within 48 hours after it is placed, the order will be deleted and a new pre-order will be placed on hold.

*By shortening the delete time, the waiting period will be shortened, which will inevitably result in fewer unfilled orders.

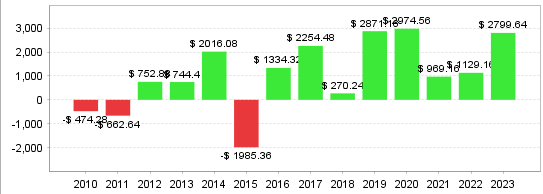

*Apex Breaker-sell captures medium-term downward trends, so if there is no trend, there will be a period of several months with no transactions. Apex Breaker-buy captures long-term upward trends, so by running each EA at the same time, the two can complement each other during the blank periods.