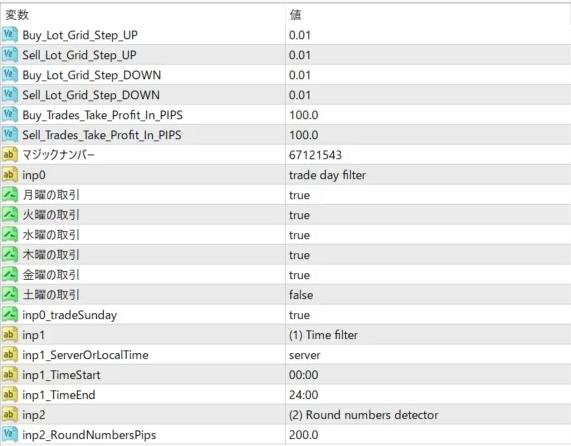

Grid trading is a strategy of simultaneously taking long and short positions and closing both profitable and unprofitable positions during periods of price retracement. This article will show you how to set the grid size in terms of price and add variable take profit positions.

A particularly useful pair for this grid trading strategy is GBPJPY, which aims to take profits in the middle of the grid, rather than when new grid positions are opened. This approach is intended to give you the opportunity to reverse if the pair's price movement reaches a final high or low.

As an example, let's consider a 200 pip grid. In this case, the take profit (TP) for the position can be taken at 100 pips on either side of the grid. If the price swings 100 pips up or down, both positions will be closed and the capital will be returned to the bank balance.

We also experimented with setting the Take Profit at 200-300 pips, which allows the position to remain open at all times, resulting in larger profits, and allows us to close the position by manually adjusting the Take Profit during the trade.

At the moment, we have a variable profit position 10 pips away from the next grid step to maximize profits when the price is trending. This allows for additional buy/sell positions, which is effective when trading the pair following the trend.

To find the right pair, we use a little calculation called the "Macro Grid Coefficient (MGC)". This is calculated by subtracting the pair's highest high from its highest low and dividing by the long-term daily ATR. The smaller this value, the better the pair is for grid trading. In other words, the smaller the macro range relative to daily volatility, the better the grid trading pair.

However, there are a few considerations for grid trading. First, it doesn't rely on indicators and has no long-term effect, so it doesn't help by adding latency to efficiency. Second, large grid steps create an optimal grid structure. And third, you need to calculate macro ranges for each pair to select the optimal trading pair.

When it comes to overcoming drawdowns (DD), you need to consider not only how to eliminate past trades, but also how to neutralize them over time and price movements, such as how to switch between buying and selling trends based on specific price action, or how to exit a trade at a specific stage.

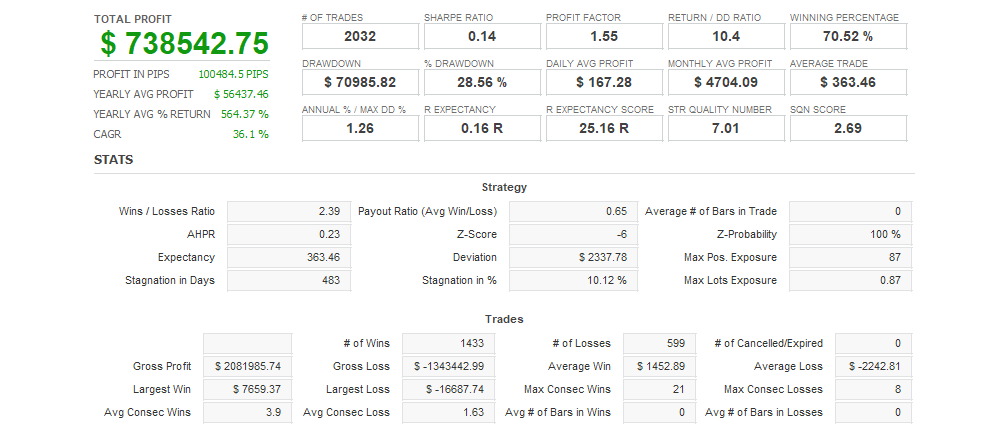

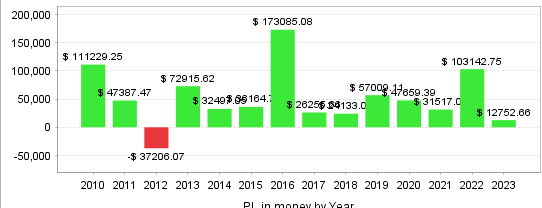

GBPJPY 4H Backtest (January 2, 2013 – January 31, 2023)

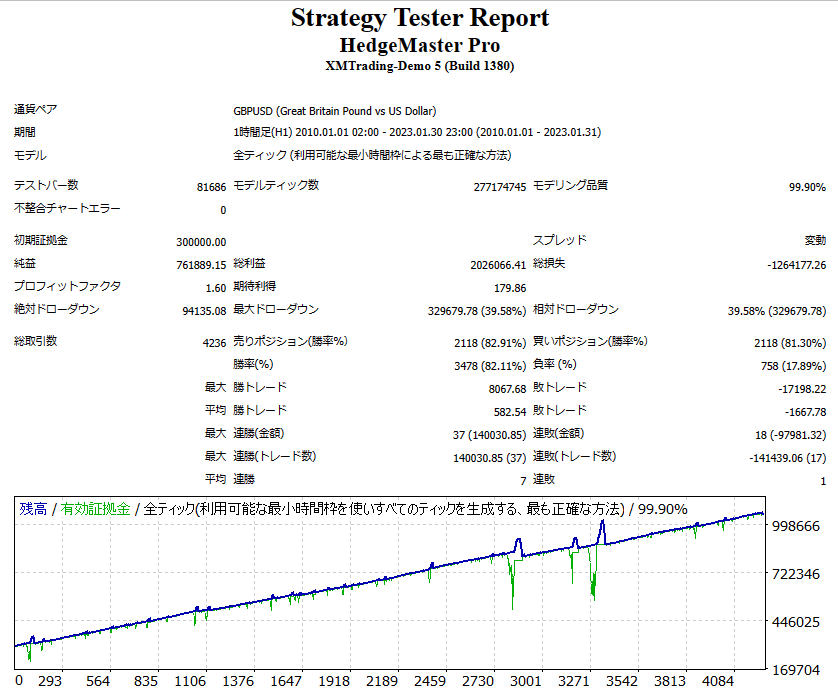

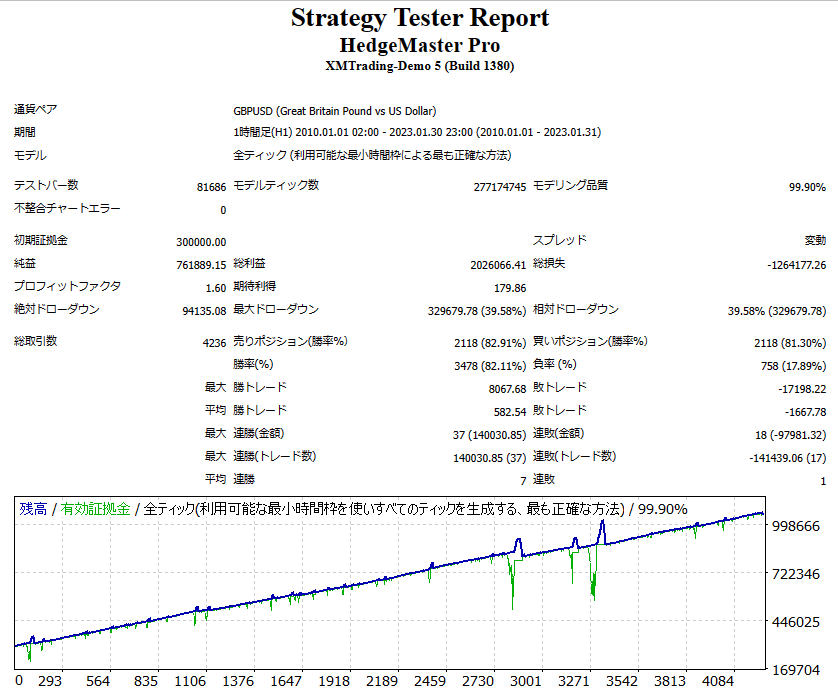

GBPUSD 1H Backtest (January 2, 2013 – January 31, 2023)

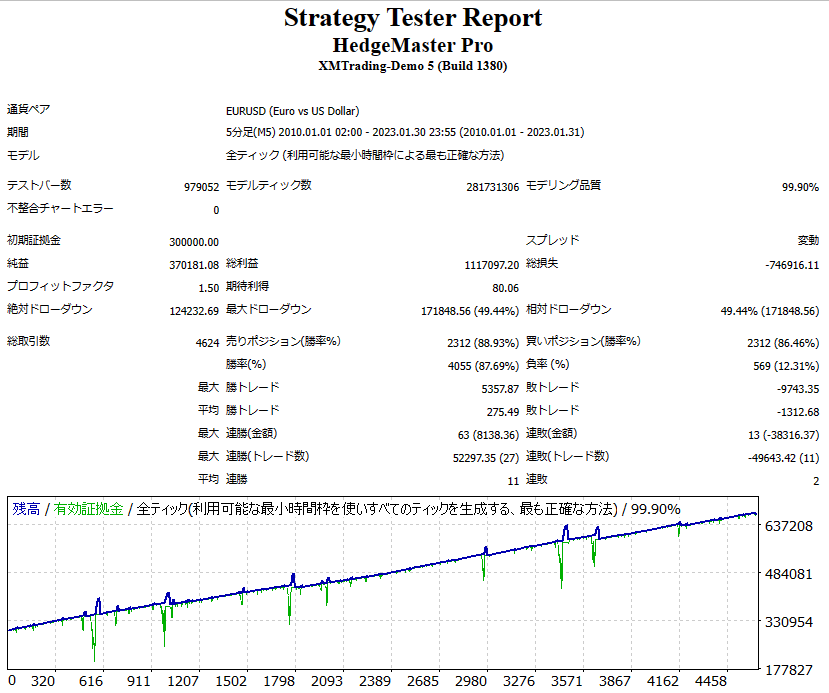

GBPUSD 1H Backtest (January 2, 2013 – January 31, 2023)  EURUSD 5M Backtest (January 2, 2013 – January 31, 2023)

EURUSD 5M Backtest (January 2, 2013 – January 31, 2023)