Have you ever had an experience like this?

The backtest showed a gentle upward curve, so you purchased an EA with a PF of 1.5 or more, but when you actually ran it, it didn't make a profit as the test showed, and you only incurred losses. Even if you were to stay afloat, it would converge to a bumpy curve of around PF=1.1, causing unexpected losses and making you want to quit automated trading.

In fact, I have had countless similar experiences, and from my own experience developing the product, I realized that the cause of this is that in order to make logic that does not have much of an advantage to begin with look good and sell it, the developer tries out all sorts of indicator parameters, and then ends up overfitting them to past market prices by setting completely unfounded values based on hindsight.

Unfortunately, it is not possible for the buyer to see through these types of schemes just by looking at the backtest, so we recommend that you only buy EAs that have a long track record or those you trust. What we pay attention to in our work is that we do not perform such meaningless optimizations, and we spend time thoroughly verifying whether the basic logic is a winning logic.

A simple logic that has continued to break new records for over 20 years

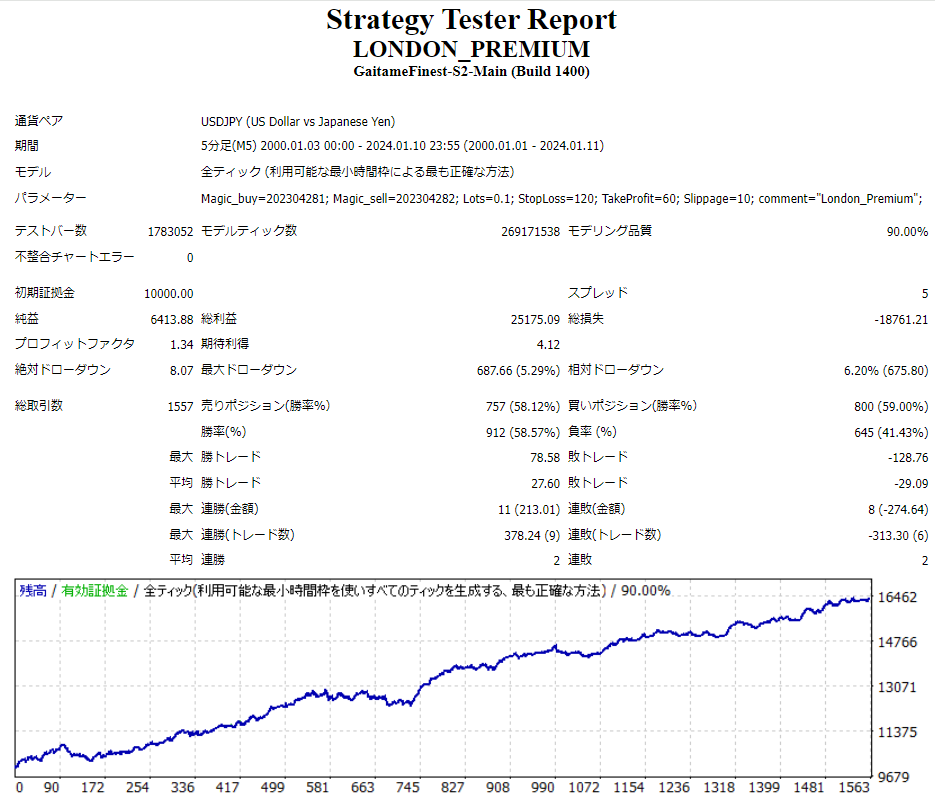

In EA, the time of trading is a crucial factor. I have released an EA called TOKYO PREMIUM that focuses on the mid-price, and after studying the price movements during London time, I discovered that there is a certain pattern, which has been steadily increasing for over 20 years. (I would like to go into the details, but please bear with me, as there will be measures in place to deal with the appearance of a plethora of new EAs like the mid-price.)

High expected gains, well-balanced risk-reward ratio

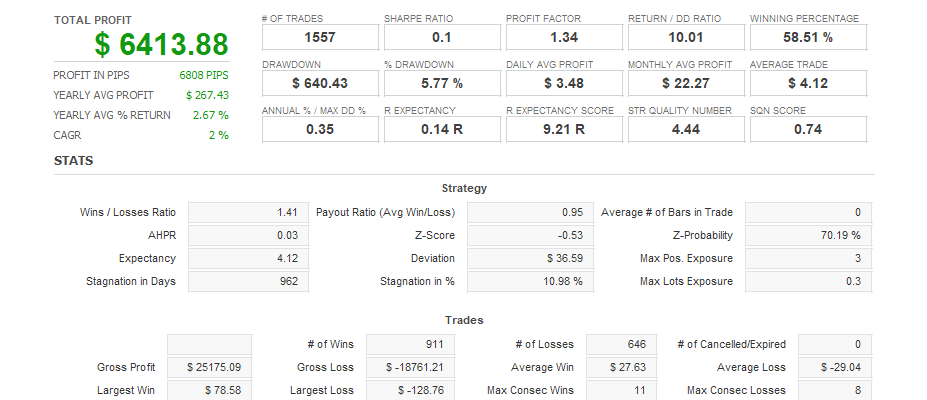

Many EAs on the market have a pattern where the SL is abnormally deep, while the TP is abnormally small. This is also convenient for selling because it makes a good impression as the price keeps rising steadily until it loses, and it is convenient for the seller to make the buyer mistakenly think that it is the Holy Grail, and when creating it, it is convenient for the seller because it allows them to create a good backtest by identifying large losing trades and adding an ad-hoc filter to avoid those trades. On the other hand, this EA does not do such cheating, and the profit and loss are just under 30 pips each, which is almost 1:1. If you create your own EA, you will understand that it is quite difficult to create a PF of 1.3 or more with a risk-reward of around 1:1 and simple logic alone.

As a test, try setting your large profit/small profit EA so that the average profit and average loss are about 1:1. Most of them will probably have a bumpy profit/loss curve and a lower PF. And the forward test will probably have a similar PF.

On the other hand, the expected profit is also very important. This EA has an expected profit of 4 pips or more, and even if the EA is generalized and its advantage decreases slightly, or it is affected by the spread in a real environment, it can still make a profit. If this is only a little over 1 pip, I will not mention the name, but after more than 1,000 copies are on the market, its advantage decreases, and what had been a long-term, stable upward trend suddenly becomes a sliding slope that keeps losing.

However, please be aware that it is not a holy grail that can be won at any time before purchasing.

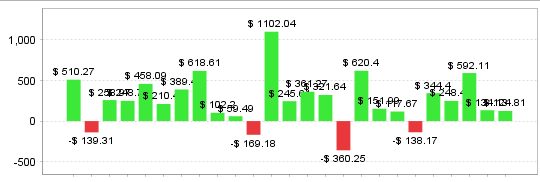

Below are the revenues by year from 2020.

Although 2023 has not yet been confirmed, there have been 20 winning years and 4 losing years. It is possible to make these 4 years profitable and sell them as if they were the Holy Grail, but I will not do that. The reason is that if the drawdown is actually estimated from the performance and the lot is set, the manager will suffer unexpected losses. Have you ever bought an EA, operated it with a fierce breath, thinking that you will definitely win, only to have the maximum DD of 20 years updated in just a few months and put it away? In fact, the sellers released it knowing this in advance, and I think that the fact that there are many EAs that are in the stance that it is okay because they made a profit from sales is a very big problem in this industry. As for my EA, I do not perform meaningless optimization, and I release it in a rough state that says, “Please be prepared for this level of DD.''

However, we are confident in its robustness, having maintained a PF of 1.3 or higher both from 2000-2010 and since 2010. We believe that unless this logic becomes widely known to the general public and a large number of people engage in the same trades emerge, there is a high possibility that it will continue to rise steadily over a span of several years.

Price Changes

Like the other EAs listed, I actually use this one for my own personal operations, so I will be gradually revising the price to avoid losing our market advantage due to a mass increase in users.

For the first three days after release, the price will be 16,800 yen, after which the price will be increased by 3,000 yen for every 30 bottles.