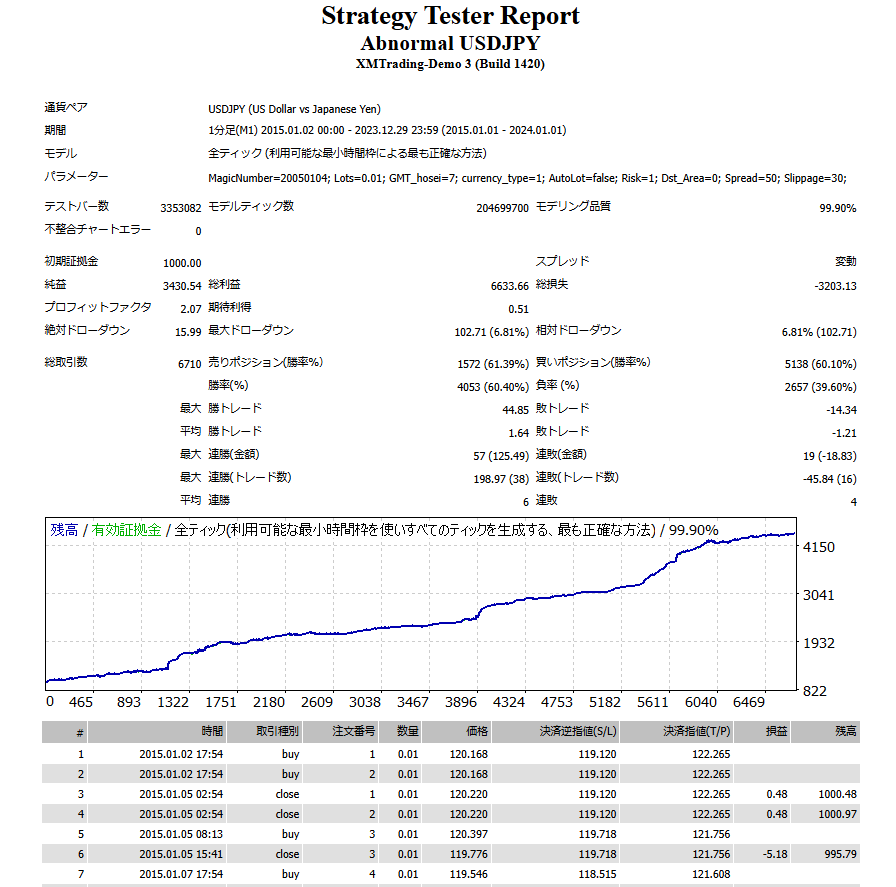

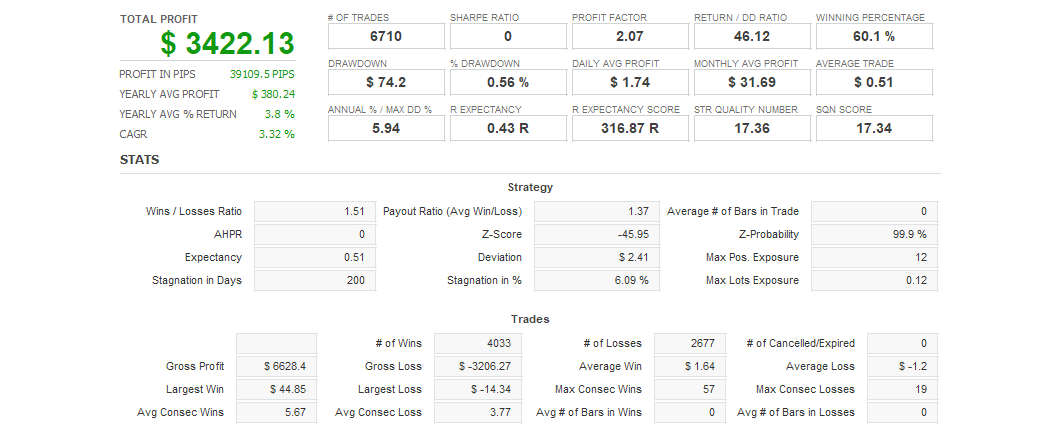

It focuses on "anomalies" (abnormal values or patterns) that occur when prices repeatedly move based on specific patterns in the actual market, and trades by capturing turning points in trends predicted based on past data.

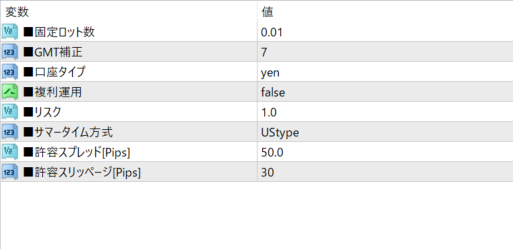

- MagicNumber : A fixed magic number, used for order identification.

- Lots : Fixed number of lots (default 0.01). Specifies the lot size for trading.

- GMT_hosei : GMT offset value. Used to adjust the server time. (Example: XM is a GMT2 broker, so the offset is 7)

- currency_type : Account type (default is JPY). You can choose yen, usd, etc.

- AutoLot : Whether or not to use compound interest (default is false). When compound interest is enabled, the lot size is automatically adjusted for each transaction.

- Risk : Risk tolerance (default is 1.0), used for risk management.

- SummerType : You can choose the summer time system US type (American type), EU type (European type), or SummerOFF (no summer time). (Example: XM = US EXNESS = SummerOFF)

- Spread : Allowable spread (default is 50.0 pips). Specify the maximum spread when trading.

- Slippage : Allowable slippage (default is 30). Set the slippage to withstand price fluctuations.