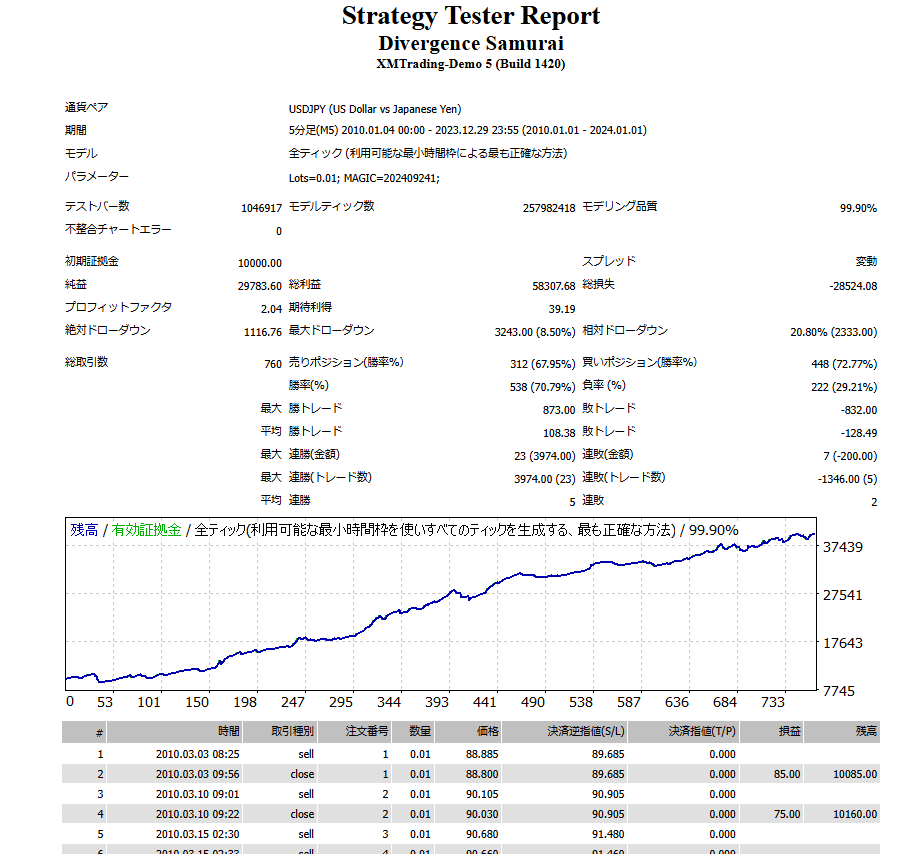

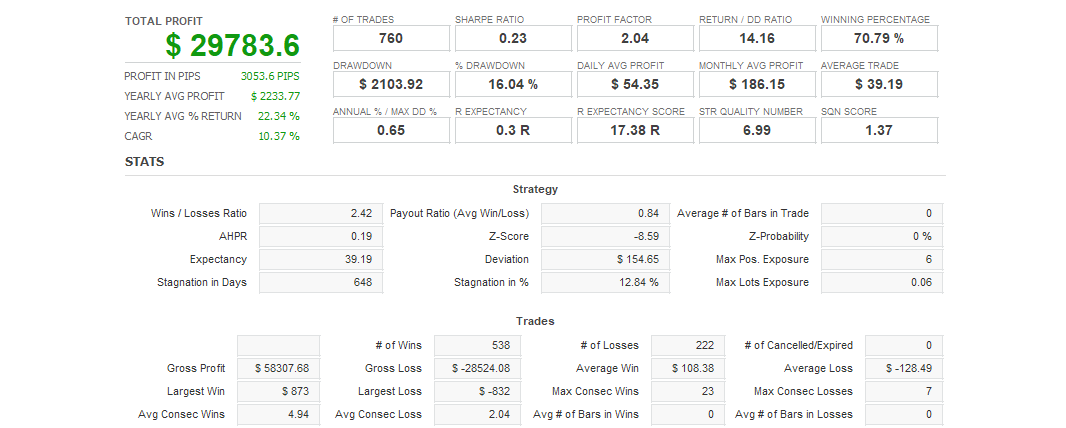

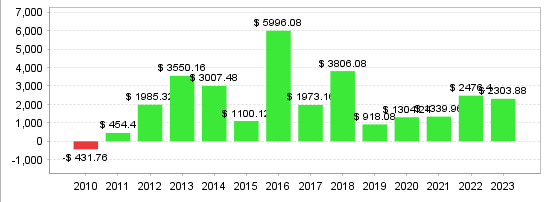

This EA is characterized by its design that strictly manages entry and closing conditions in trades, and efficiently pursues profits while minimizing risk. It can flexibly respond to market movements, and utilizes a unique algorithm to maximize performance in stable trend and range markets. First, the entry conditions mainly utilize oscillator-type technical indicators to capture trend reversals and price overheating. When the market reaches a certain price level or approaches an important point compared to past price movements, entry is executed while managing risk. In this way, entry points are carefully selected, and risk is minimized by avoiding wasteful trades. For closing conditions , positions are also settled based on very detailed indicators and conditions. In particular, it is designed to automatically close positions when profits reach a certain level or when a signal occurs in the opposite direction to the time of entry. This provides a mechanism for limiting losses while locking in profits. The market environment in which this EA excels is range markets and stable trend markets. Especially during periods when market movements are slow and stable, it is possible to accurately capture short-term price changes, and as a result, it is possible to steadily accumulate profits. Since it performs well in stable markets, it is suitable for traders who want to operate steadily. On the other hand, market environments that are difficult to handle include sudden price fluctuations and situations that are difficult to predict. In situations where the market moves suddenly and significantly or in markets with extremely high volatility, the performance of the EA may decrease. In particular, it is difficult to respond to sudden market movements due to news, and entry conditions are often not met, so caution is required in such markets. You also need to consider the timing of operation . From the perspective of risk management, it is recommended to suspend the operation of the EA when economic indicators are announced, when important news is expected, and even during the year-end and New Year holidays when the market is quiet. Trading under such circumstances is difficult to predict, and careful measures are required to avoid unexpected losses. Finally, as a recommended operation method , it is recommended to start with a small lot size in order to thoroughly manage risk. By proceeding with trading within a reasonable range and gradually adjusting the risk while operating, it is possible to steadily accumulate profits. This EA is particularly strong in stable market environments, so by using it in conjunction with careful capital management, it will become a reliable operation partner in the long term.

Total Profit

3,799