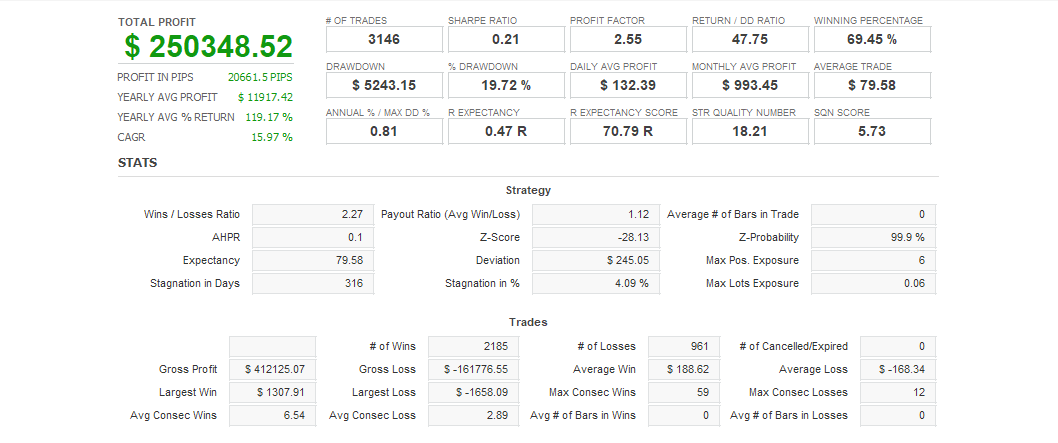

Total Profit

6,848

TokyoTime

TokyoTime

EuropeTime

EuropeTime

F-montecarlo

F-montecarlo

European time strategy! High-precision time zone EA

¥0 – ¥19,800Price range: ¥0 through ¥19,800

| Entry Time | Type | Open Price | Symbol | Lot Size | Floating P/L |

|---|---|---|---|---|---|

| 2026-02-18 02:55:01 | SELL | 181.516 | EURJPY | 0.01 | -266.00 |

| Close Time | Type | Open Price | Close Price | Symbol | Hold Time | Lot Size | Profit/Loss |

|---|

Recommended Fund: $100 USD

Expected Monthly Return: 10%

There are no reviews yet.

For product inquiries,

please contact the store.

* You can check the confirmation and reply after the inquiry from "Inquiries" in My Account.

非会員様もご購入いただけますが、サポートは対象外となります。

サポートをご希望の方は、会員登録のうえでご購入ください。

Arcana Tokyo

¥0 – ¥29,800Price range: ¥0 through ¥29,800

Arcana Tokyo

¥0 – ¥29,800Price range: ¥0 through ¥29,800

CSMV_EURCAD

¥0 – ¥19,800Price range: ¥0 through ¥19,800

CSMV_EURCAD

¥0 – ¥19,800Price range: ¥0 through ¥19,800

F-montecarlo

F-montecarlo

PON WATAER(rev1)

PON WATAER(rev1)

KiwiForex

KiwiForex

GiveHapiness

GiveHapiness

K_Kewl_USDJPY_SC

K_Kewl_USDJPY_SC