I want to achieve the ultimate in hands-off trading . "Is there an EA that I can operate with peace of mind?" This is what led to the development of TripleBullet. Even if it is an automatic trading (automatic settlement), you still have to think about it yourself and set it up each time. This is more like "semi-automatic trading" than "automatic trading", and there is a large opportunity loss in terms of time. Above all, "thinking about and setting up each time" means " constantly updating your knowledge to keep up with the times". In the end, even if you spend a fair amount of money to introduce EA,

- It is unlikely to be a positive result in the long term

- The spread gets larger and before you know it, you'll incur losses.

- The amount of time spent glued to the desk has not changed much since the introduction, and the time that could have been used there is gone.

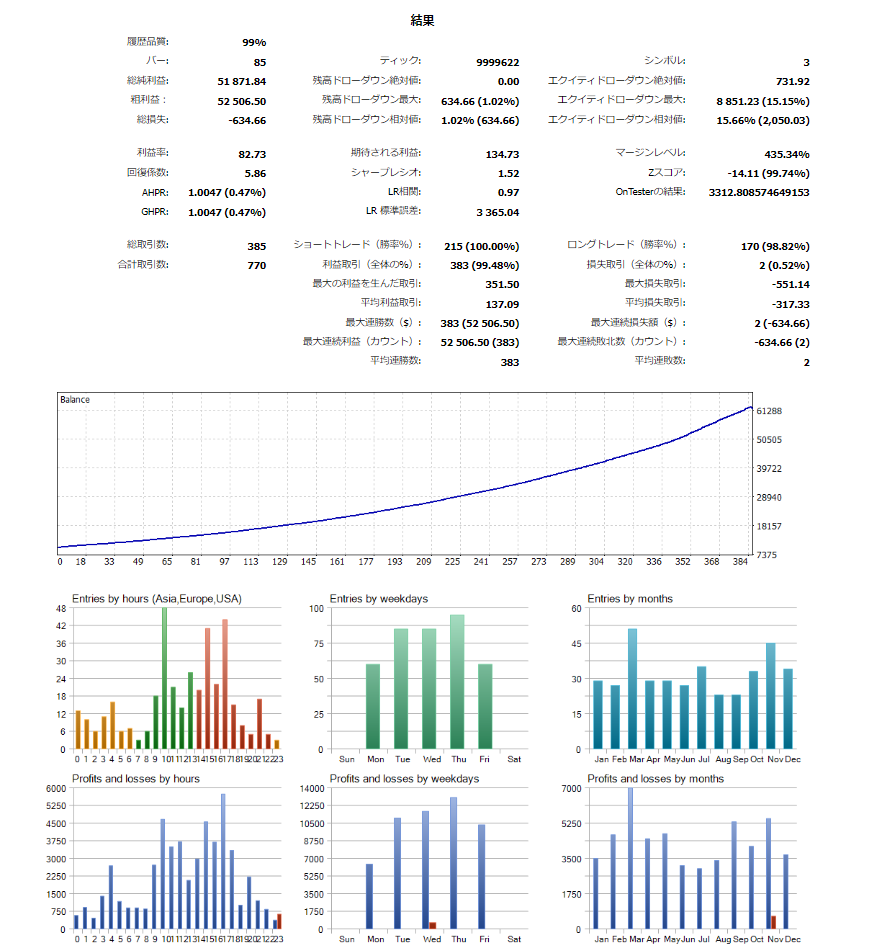

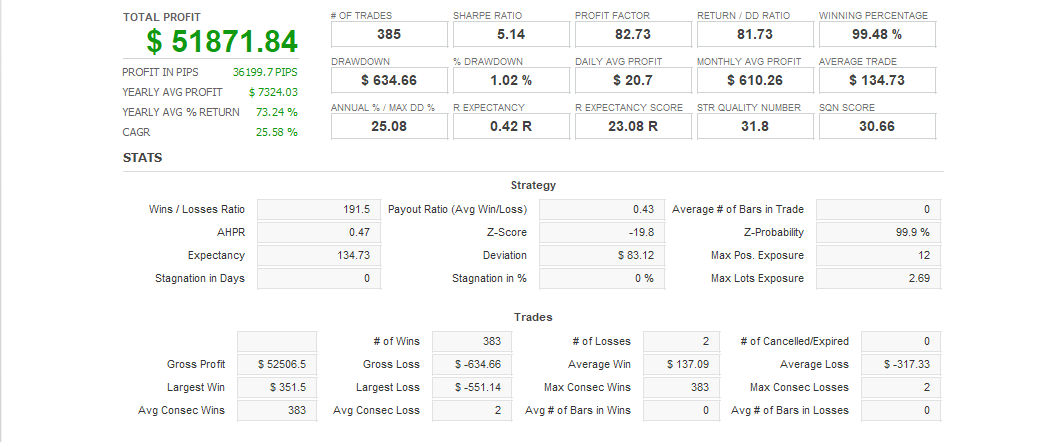

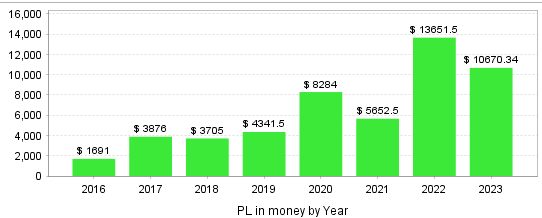

Disadvantages such as the following are also more likely to occur. This means that the "profit" that you were originally hoping to achieve by introducing EA will not be realized, and time will just pass by. How can we eliminate these disadvantages? Is there a way to operate EA more safely, more easily, and more reliably while eliminating the risks associated with it? TripleBullet is the answer to this question. *In order to help you use the product after purchase, we have prepared a simple quick start guide in this chapter and a detailed manual in PDF format inside the product. It may be difficult to visualize the product before use, but we would appreciate it if you could check the images and use them as you consider your purchase. Highlights of this EA This EA takes various factors required for an EA, such as "risk," "time," and "profit," to the extreme. Point 1: Ultimate durability! "Strength" that is not affected by market conditions This EA uses a grid trade strategy. The greatest strength of the grid trade strategy is that it is not affected by market conditions or past data. General technical analysis predicts prices from past data and patterns, so it is heavily influenced by market trends and can sometimes result in significant losses. On the other hand, grid trading strategies are said to be a method that can continue to be used for many years, without being affected by events that cause major fluctuations in the market environment or uncertain factors in the future . In addition, this EA incorporates the latest candlestick data each time and constantly updates the strategy. No matter how successful you are, if you have to reintroduce it in a short period of time, it won't give you true peace of mind. This is because you will have to continue preparations to be able to generate profits again in a few years' time. The running costs are low , and you don't have to worry about settings every time you install it. This is one of the strengths of this EA. Point 2: The ultimate investment range! Diversified investment Most general EAs can only trade one pair, but this EA allows you to trade three pairs. The advantage of being able to use multiple currencies is that you can reduce risk by diversifying your investment . For example, even if you incur an unrealized loss on the main currency, you can make up for it with the second and third pairs. Example settings: Low-priced pairs (e.g. USDCHF / EURGBP / AUDNZD) Negatively correlated pairs (e.g. USDJPY / S&P500) etc. There is also no limit to the currency bears, so you can choose from a wide range of options. For example, you can choose from S&P500 (CFD), Bitcoin (BTCUSD), Gold, etc. I think that a truly good EA is not one that takes high risks in an attempt to get rich quick, but one that avoids the risk of extreme losses and continues to make stable profits . TripleBullet is tuned to suit various currency pairs, making it very "robust" and "solid". This specification minimizes the chance of incurring losses, allowing you to operate with peace of mind, both financially and psychologically. Point 3: Ultimate risk management! Safe function The scariest thing is to have a huge unrealized loss without realizing it. Even if you think you can earn a lot of money without spending time by purchasing EA, you cannot avoid checking for these risks, and it is difficult to achieve the goal of "earning a stable income without much effort." This EA is packed with so many features that you can leave it alone with peace of mind. It is very rare to see an EA developed with such consideration for the "risk" of the user. It allows you to pursue profits without being obsessed with profits. Triple Bullet in numbers The following is the actual data that the author actually used on a real account for approximately two and a half years from October 2022 to March 2025. https://www.myfxbook.com/portfolio/triplebulleteurgbptimesusdchftimesaudnzd/10541267 The annual interest rate is approximately 20 %, with a maximum drawdown of less than 14 %. To be honest, it is very rare to find an EA that can achieve these figures while managing risk so thoroughly. Here we will also post the expected profits calculated through 7 years of backtesting. The expected return after seven years of operation is $50,000 with $10,000 in seed money. The performance data and tests mentioned above have shown very good results, so you can see that there is a high possibility of continuing to produce stable results. The maximum drawdown (the percentage of unrealized losses relative to the deposit amount) is just 16%. Can a method of investment that involves putting one's entire assets at risk in order to generate large profits be called "investment" or "asset management" ? "You can achieve results with minimal risk while pursuing maximum profits." This is not limited to this EA, but I think this is the function that is originally expected of EA. I think TripleBullet is the strongest automated trading software that fulfills the role of EA and delivers results without taking too much risk. Profits are not something that you can be happy about for a moment, but something that you can keep making stable profits over a long period of time . Investment is investment after all. There is no EA that only produces profits. Even though there are losses, there are twists and turns, and you will eventually be able to make money. (If there was a service that guaranteed high profits, it would not be an exaggeration to say that it was a scam.) A quick start guide for beginners to EA For those considering EA for the first time, or those who have considered its introduction in the past, are you troubled by the enumeration of technical terms and parameter settings that you don't know which one to choose ? Frankly speaking, I think that understanding the detailed settings and operating them while making adjustments on your own is a very high hurdle for beginners. Even though you are trying to make a profit through automated trading, leaving the detailed settings entirely up to the user means that you cannot manage risk, and you will have to proceed with the uncertainty of whether the settings are really correct. In preparation for such a situation, TripleBullet has prepared a quick start guide so that anyone can easily get started ♪ Of course, you can set it up yourself, so it is an EA that beginners to advanced traders can use for a long time with confidence. For those who have tried other EAs and failed. For those who are trying it for the first time. As a developer, I can confidently recommend this EA. Please consider the EA "TripleBullet" which was built with the user's interests in mind. *Detailed specifications will also be included in the product file you purchased. Beginner's quick start guide You can quickly get started by performing the following setup and running the EA. set up

- Provide accounts that allow for hedging

- Maximum leverage set at 25x

- Specify the monthly time frame

- The currency pair is EURGBP.

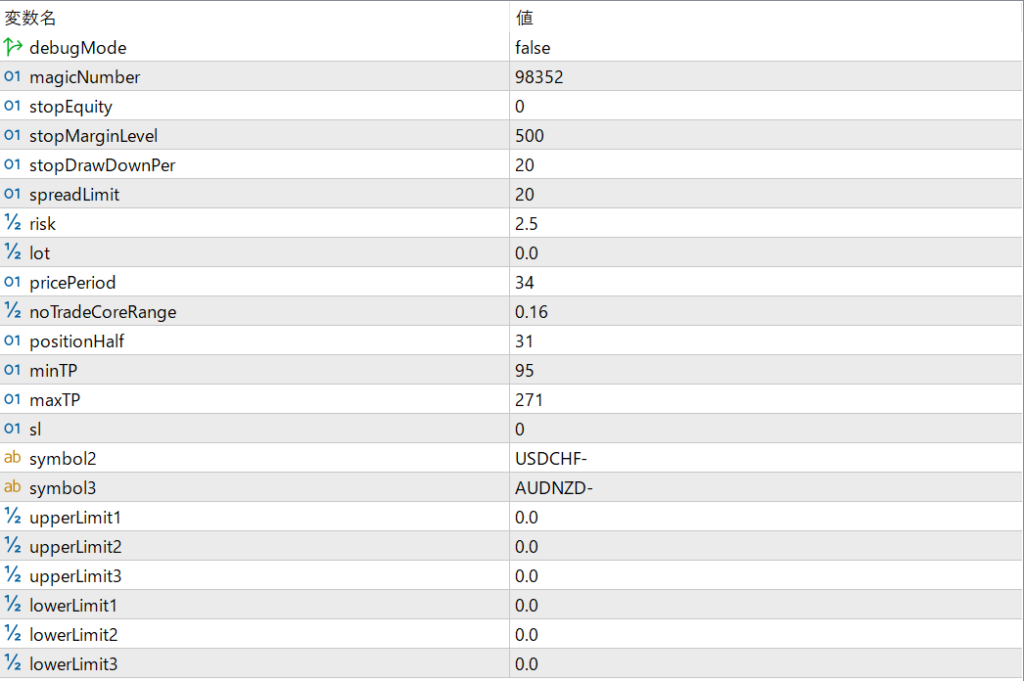

Configuration parameters Parameter ValueRoll UsagedebugMode false Log outputWhen true, displays debug log in journal.magicNumber 98352 Magic numberPlease set a unique value that does not overlap with other EAs.stopEquity 0Safety functionWhen the available margin is below stopEquity, no new orders will be placed.To disable, set to 0.stopMarginLevel 500Safety functionWhen the margin maintenance rate is below stopMarginLevel, no new orders will be placed.To disable, set to 0.stopDrawDownPer 20Safety functionWhen the drawdown is above stopDrawDownPer, no new orders will be placed.To disable, set to 0.spreadLimit 20Safety functionWhen the spread is above spreadLimit, no new orders will be placed.To disable, set to 0.risk 2.5Safety functionBy setting the risk parameter, the lot is automatically calculated.You cannot set risk and lot at the same time.To disable, set to 0.lot 0Safety functionFixes the lot during trading. Risk and lot cannot be set at the same time. To disable, set it to 0. pricePeriod 36 Trading strategy Determines how many months to use for calculation. noEntryZone 0.16 Trading strategy Stops trading if the price is within the reference value ± [noEntryZone]. positionLimit 31 Trading strategy Determines the maximum number of positions that can be held at one time. minTP 95 Trading strategy Determines the minimum TakeProfit (in pips) that can be taken for a position. maxTP 175 Trading strategy Used to calculate the maximum TakeProfit (in pips) that can be taken for a position. Maximum TakeProfit = [maxTP] + [minTP] sl 0 Trading strategy Specifies the stop loss in pips. 0 is disabled (no stop loss). symbol2 USDCHF Pair selection Determines which pair to trade additionally. Be sure to check the correct currency pair name on MarketWatch. symbol3 AUDNZD Pair selection Determines which pair to trade additionally. Be sure to check the correct currency pair name on MarketWatch. upperLimit1 0 Trading strategy: If the rate of the first pair (pair on which EA is running) is higher than upperLimit, trading will be stopped. To disable, set this to 0. upperLimit2 0 Trading strategy: If the rate of the second pair (symbol2) is higher than upperLimit, trading will be stopped. To disable, set this to 0. upperLimit3 0 Trading strategy: If the rate of the third pair (symbol3) is higher than upperLimit, trading will be stopped. To disable, set this to 0. loweLimit1 0 Trading strategy: If the rate of the first pair (pair on which EA is running) is lower than lowerLimit, trading will be stopped. To disable, set this to 0. loweLimit2 0 Trading strategy: If the rate of the second pair (symbol2) is lower than lowerLimit, trading will be stopped. To disable, set this to 0. lowerLimit3 0 Trading strategy: If the rate of the third pair (symbol3) is lower than lowerLimit, trading will be stopped. To disable, set it to 0.