■■ 🎯 "Reconstructing the 'key points' of discretion with logic and precision" ■■

A selective scalping EA that uses 8 logics to target only the "moments when you can win."

▼ 🔧 EA Overview|CoreLogic_Catalyst_AUDCAD_M15

This EA is a "select-type scalping EA" that allows users to select and operate up to eight independent logics. Target currency: AUDCAD Time frame: M15 (15-minute chart) Expected style: Short-term scalp + nanpin-type recovery

✨Feature Pickup:

– "Signal-distributed division of labor" structure using multiple logics – Operates with simple interest and fixed lots (no marting) – Individual on/off and maximum position control possible for logics – "Currency-distributed complementary" structure with seven Precision/Core series further enhances stability. By combining "logic groups that are close to the perspective of discretionary traders" with "mechanical entry management," it enables smart operation with high precision, low frequency, and short-term settlement. Furthermore, this EA is part of a series consisting of seven Precision (M30) and CoreLogic (M15) series, and is designed to reduce time-axis and logic conflicts between entries in each currency (AUDCAD/AUDNZD/NZDCAD/USDCAD).

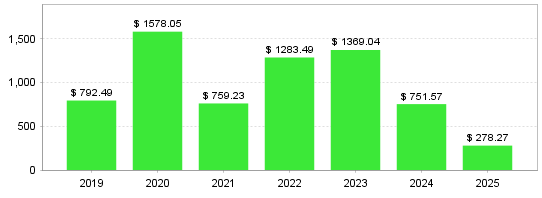

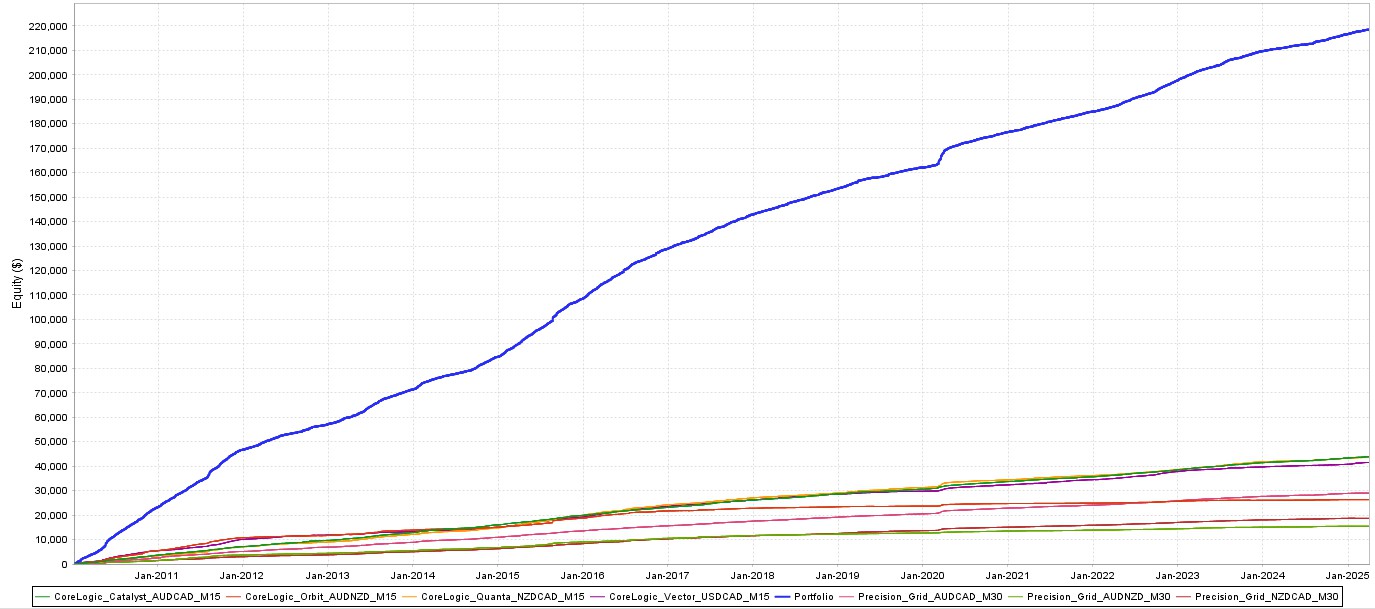

📊 By using all 7 strategies together, **the timing to win will be mutually complementary, resulting in a steady accumulation of daily profit opportunities**.

▶ You can check out each EA here:

https://sys-tre.com/shop/precision_grid_audcad_m30/ https://sys-tre.com/shop/precision_grid_audnzd_m30/ https://sys-tre.com/shop/precision_grid_nzdcad_m30/ https://sys-tre.com/shop/corelogic_catalyst_audcad_m15/ https://sys-tre.com/shop/corelogic_orbit_audnzd_m15/ https://sys-tre.com/shop/corelogic_quanta_nzdcad_m15/ https://sys-tre.com/shop/corelogic_vector_usdcad_m15/

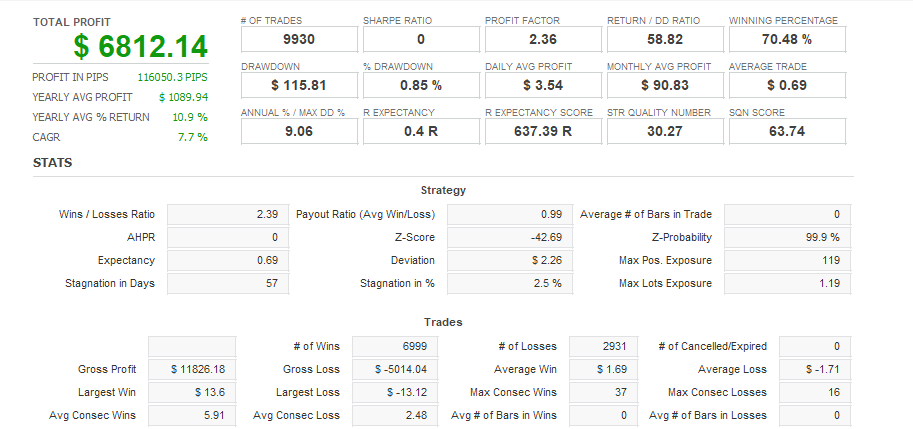

📈 Forward performance (Myfxbook)

▶︎ Actual real-time results are now available! Myfxbook link

▶▶[Please see below for an image of distributed operation across the entire series]

▼📊 EA that embodies "statistical superiority" through logic and variance control

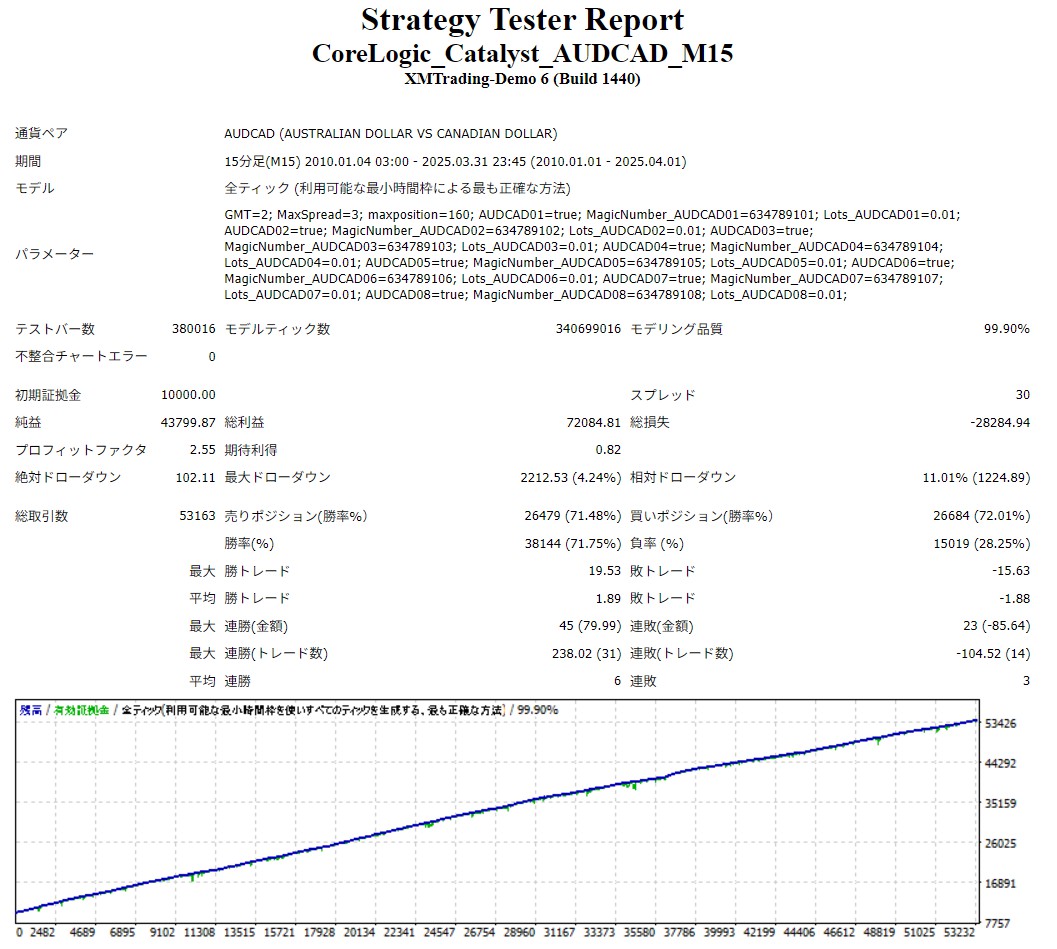

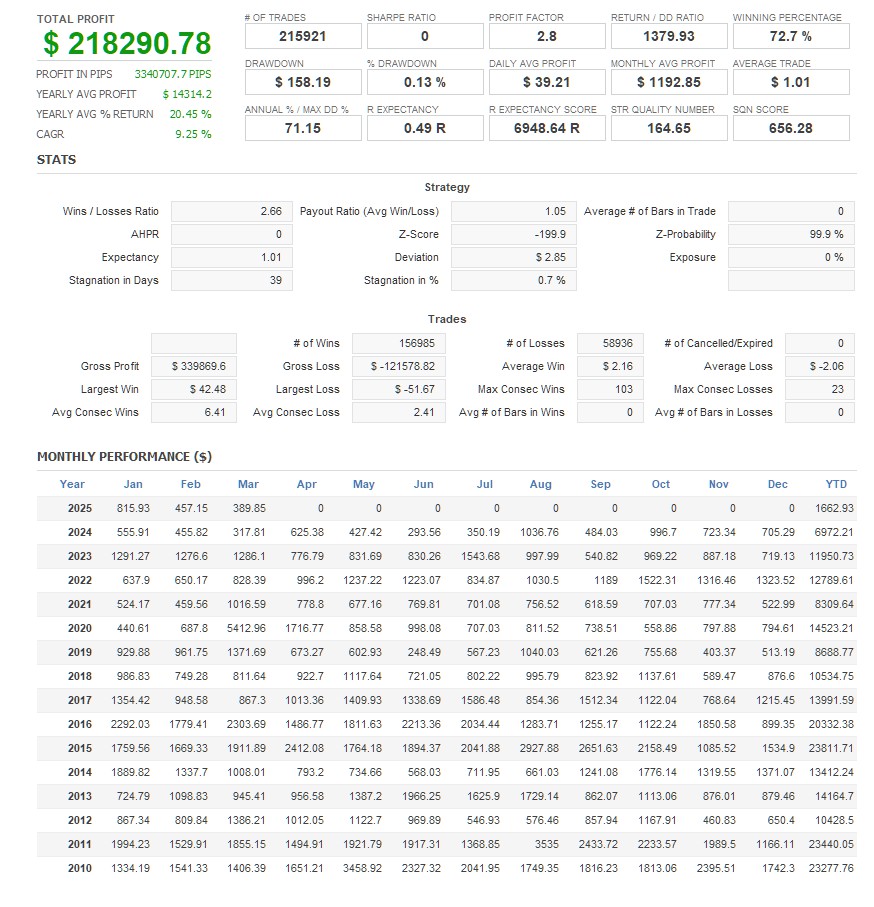

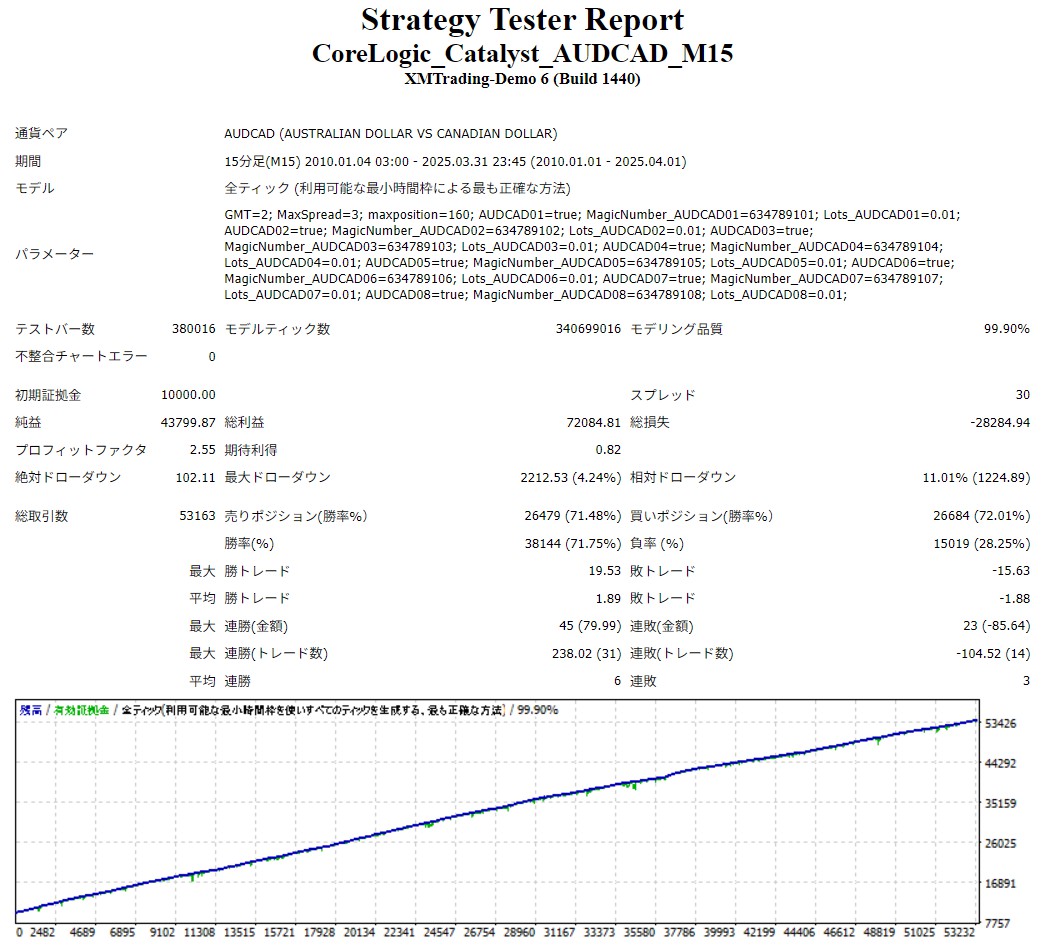

🧪 Understanding the backtest results──CoreLogic_Catalyst_AUDCAD_M15's "reliable performance"

This EA has recorded extremely high stability, with a profit factor of 2.55, a win rate of 71.75%, and a maximum drawdown of 4.24% over approximately 15 years of AUDCAD (M15) data from 2010 to 2025. [3 points worth noting in particular]

✅ 1. Recovery Factor (RF) = 19.80

→ Calculated from a net profit of 43,799 / maximum DD of 2,212. ★ The RF of just under 20 is "extremely excellent" for scalping. Taking advantage of the high trading frequency, a structure has been created that allows for quick returns without digging too deep.

✅ 2. Profit Factor (PF) = 2.55

→ Profits are 2.5 times greater than losses. ★ Designed to ensure no trade is wasted, even with high-speed, high-volume trading. Filter precision and simultaneous activation control are meshed at a high level.

✅ 3. Win rate of 71.75% × 53,163 trades (an overwhelming number of trials)

→ ★ With over 50,000 trades, we have consistently maintained a win rate of over 70%. Even on 15-minute charts, we are able to avoid holding excessive positions thanks to our highly accurate logic and diversified design.

💡 And more──

・Modeling accuracy is 99.90%, with zero mismatch errors. ・Loss per lot is also extremely small, ensuring stable operation within a "maximum number of 160 positives control."

📈 Overall Review:

★ Run it hard and accumulate little by little. ──An EA that embodies the ideal "asset-building scalping." ★ Here you can find the reliability created by careful design philosophy and overwhelming statistical data.

📚 The "asset management" approach of the nanpinning strategy – The theoretical basis of this EA

This EA employs a "solid nanpinning strategy" that applies three long-standing, standard theories in asset management: dollar cost averaging, value investing, and portfolio management. While many may be wary of the risks inherent in these nanpinning strategies, this EA's approach is not simply nanpinning; it combines multiple investment theories, including the following: First, similar to dollar cost averaging, a well-known method of investment savings, increasing positions when prices fall effectively lowers the average price. This is an extremely rational strategy that automatically buys at low prices and seeks profit opportunities when the market recovers within a certain range. Furthermore, this EA is designed for use with multiple currency pairs. Similar to the fundamental asset management concept of "portfolio diversification," this EA diversifies risk by taking advantage of differences in the price movements of each currency. This avoids unidirectional risk and achieves more stable operations. Furthermore, similar to the concept of "value investing," which aims for future profits by investing when prices are low, this EA offers a solid and practical approach that "turns market distortions into opportunities." Rather than simply averaging down, this EA aims to achieve highly rational management in the medium to long term by combining these multiple investment theories.

▼ 🧠 Logic for extracting winning patterns, refined through variance and statistics

This EA is composed of 8 logics that capture the "trend" of price rebounds from multiple perspectives. From the "seemingly disparate reactions," it extracts and selects only the patterns that are likely to win, aiming for a statistically advantageous contrarian entry. [3 Representative Logics]

💡 BB cross reaction type: Mechanical contrarian trading based on the upper and lower limit bands

→ Enter when the candlestick clearly breaks the Bollinger Band 1σ line. This replicates the discretionary contrarian decision of "falling too far or rising too far."

💡 RSI x CCI combined type: High-precision filter targets only genuine rebounds

→ Detects only when RSI and CCI simultaneously exceed a certain level, and reconfirms it over multiple time frames. Reversal detection logic prioritizes accuracy.

💡 Takayasu MA Cross Type: Grasp the "tide" with the band change of the moving average

→ It reacts to the moment when the MA based on highs and lows reverses slightly. A sniper-type logic that is sensitive to short-term trend changes.

▼🔧 Easy to operate. Freely adjustable.

This EA allows users to adjust the following items as desired. Even without detailed optimization, the default settings provide sufficiently stable operation. ・Lot size: Can be set for each logic (default: 0.01) ・Maximum number of positions: Managed by the maximum number of positions for all logics combined ・Magic number: Automatically assigns a unique identification number to each strategy ・Strategy ON/OFF switching: Eight strategies can be enabled/disabled individually

⚙ Risk management is also designed

・No infinite nanpinning ・Maximum number of positions limited

▼📘 What are the EAs in the Null Store? ──Precisely designed "discretionary thinking EA group"

★ Null Store's EA is a brand that aims to implement "a market view like a discretionary trader" into EA. Each entry is precisely designed to be made at a "reasonable timing." This CoreLogic series is structured so that the initial entry is made with logic aimed at short-term contrarian scalping, and then gradually diversifies and averages down depending on the market conditions.

⚙ Target series composition

・M30: Precision_Grid series → AUDCAD/AUDNZD/NZDCAD ・M15: CoreLogic series → AUDCAD/AUDNZD/NZDCAD/USDCAD ★ The averaging down strategy involves a certain amount of risk, but a structure has been adopted to avoid excessive risk concentration by using a filter design to reduce wasted investments and by suppressing simultaneous activation through decentralized logic.

👉 Other EAs here

https://sys-tre.com/shop/precision_grid_audcad_m30/ https://sys-tre.com/shop/precision_grid_audnzd_m30/ https://sys-tre.com/shop/precision_grid_nzdcad_m30/ https://sys-tre.com/shop/corelogic_catalyst_audcad_m15/ https://sys-tre.com/shop/corelogic_orbit_audnzd_m15/ https://sys-tre.com/shop/corelogic_quanta_nzdcad_m15/ https://sys-tre.com/shop/corelogic_vector_usdcad_m15/

▼ ⚠ Please be sure to check before use

・This EA is based on past market data. ・It does not guarantee future profits. ・Please use this EA at your own discretion.