Currency Finalis can handle up to 30 currency pairs! Monitor multiple currency pairs simultaneously.

Key Features

Equipped with nanpin (recovery logic)

Equipped with a nanpinning function that automatically increases the lot size according to the deviation. Supports up to 20 levels, allowing you to build a highly resilient portfolio.

Trailing Stop Function

Once a position has achieved a certain level of profit, the stop loss line is automatically raised, minimizing risk while securing profits.

Time Zone Filter

You can enter only during any time period. You can also set it to avoid late night hours or when indicators are announced.

Auto-close function

Depending on the number of positions and price deviation conditions, the closing process will be executed automatically when the profit taking conditions are met.

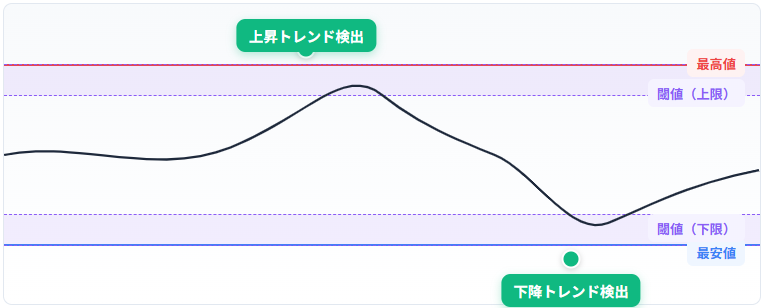

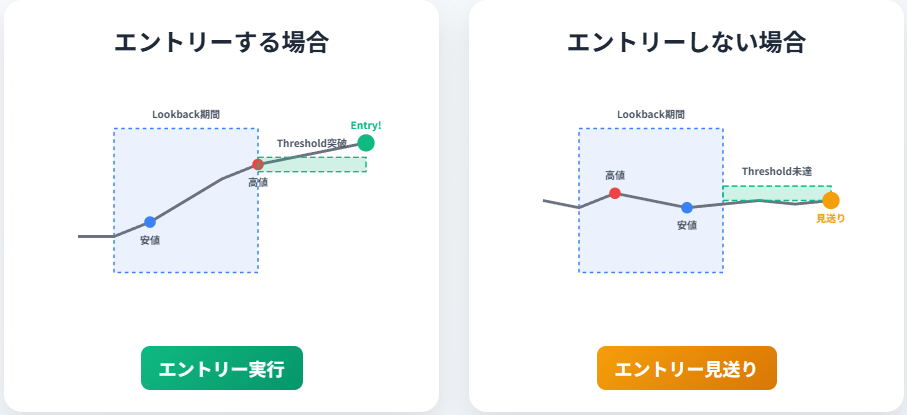

Entry Logic

The entry logic uses the relationship between the high and low prices (Lookback x Threshold) over a specified period as an indicator, and aims to establish a position at the beginning of a trend or at a reversal phase.

This means analysing past price movements to determine entry times.

First, we check the highest and lowest prices within the set period and then apply a criterion called a threshold.

This allows you to find out when a trend is starting to emerge or if there are signs of a change in direction.

However, if no clear buy or sell signals are confirmed, trading will be refrained from, allowing for efficient operation while minimizing risk .

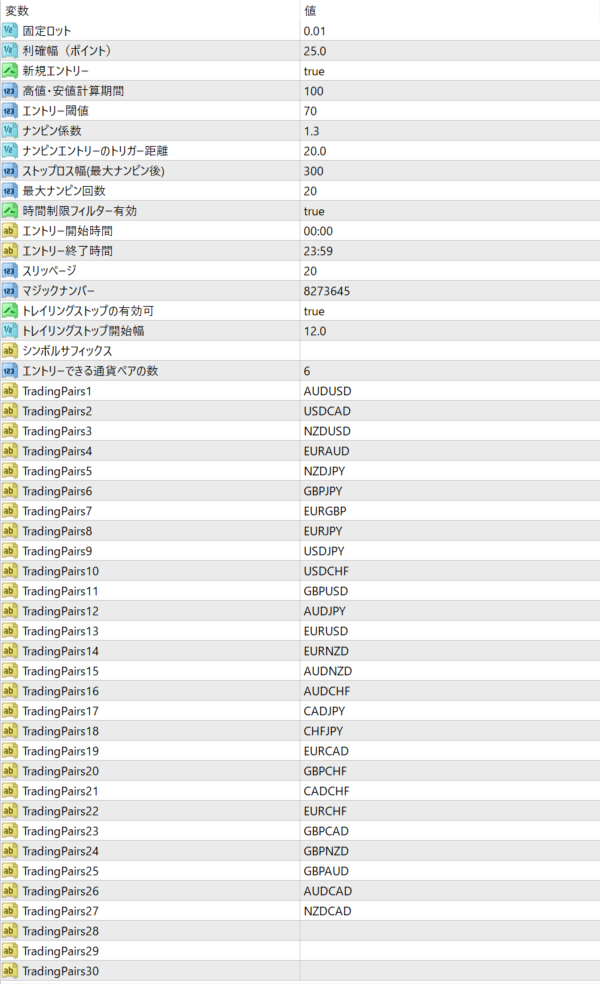

Settings (example)

-

Lot: 0.01 fixed (UseAutoLot=false)

-

Take profit: 25 points

-

Stop loss: 300 points

-

Nanpin interval: 20.0 points

-

Maximum number of nanpins: 20

-

Entry time: 00:00-23:59 (no restrictions)

-

Trailing Stop/Auto Close: Enabled

-

Chart Settings: 1 Chart Setup

① Stability-oriented portfolio (major currencies)

USDJPY / EURUSD / AUDUSD / EURGBP / USDCAD / AUDCAD

-

Recommended margin : 500,000 yen

-

Recommended timeframe : M15

-

MaxActivePairs (number of symbols allowed simultaneously) : 3

Relatively low volatility and low risk when averaging down.

This nanpinning EA is easy to use even for beginners and is ideal for long-term stable operation .

② Balanced portfolio (including medium-volatility currencies)

EURJPY / GBPUSD / NZDJPY / EURAUD / GBPAUD / AUDCHF

-

Recommended margin : 700,000 yen

-

Recommended timeframe : M15

-

Max Active Pairs : 3 to 4

It is mainly composed of currencies with a medium fluctuation range.

It is possible to operate with an awareness of the balance between profitability and stability .

3) High-yield portfolio (focusing on high-volatility currencies)

GBPJPY / GBPNZD / EURNZD / CHFJPY / CADJPY / GBPCAD

-

Recommended margin : 1 million yen

-

Recommended timeframe : M15

-

Max Active Pairs : 2

Excess margin is essential to prepare for sudden fluctuations.

While it allows for short-term profits, it also carries a higher risk .

Recommended for intermediate and advanced traders.

④ Diversified portfolio of minor currencies (medium to high spread)

NZDCAD / NZDCHF / CADCHF / EURNZD / AUDNZD / GBPAUD

-

Recommended margin : 800,000 yen

-

Recommended timeframe : M15

-

Max Active Pairs : 2 to 3

Although the spread is wide, we select pairs that tend to move within a certain range .

Designed to avoid currency correlation and specialize in decentralized operations .

⑤ Simple operation type (single or dual pair)

USDJPY / EURUSD

-

Recommended margin : 300,000 yen and up

-

Recommended time frame : M15-M30

-

Max Active Pairs : 1 to 2

Operated with a minimum configuration.

Ideal for those who simply want to check operation or for those who want to start small .

You can also use it to gradually add more currencies while understanding how the EA works.

Default currency pair configuration

Currency Finalis allows you to register up to 30 currency pairs for entry , but the following 26 currency pairs are pre-registered by default. Managing multiple currencies on a single chart allows for simple and flexible portfolio management.

List of default registered currency pairs (TradingPairs1 to 26)

Operational Points

-

These currency pairs are a candidate list for a maximum of 26 currency pairs , and in actual operation, the number of simultaneous operations is controlled by MaxActivePairs (e.g., 3 to 6 currency pairs are recommended).

-

To disable a currency pair, simply leave the corresponding TradingPairsX blank.

-

The recommended time frame is M15 .

It can also be run on M5, but caution is advised as it is more susceptible to spreads and server delays.