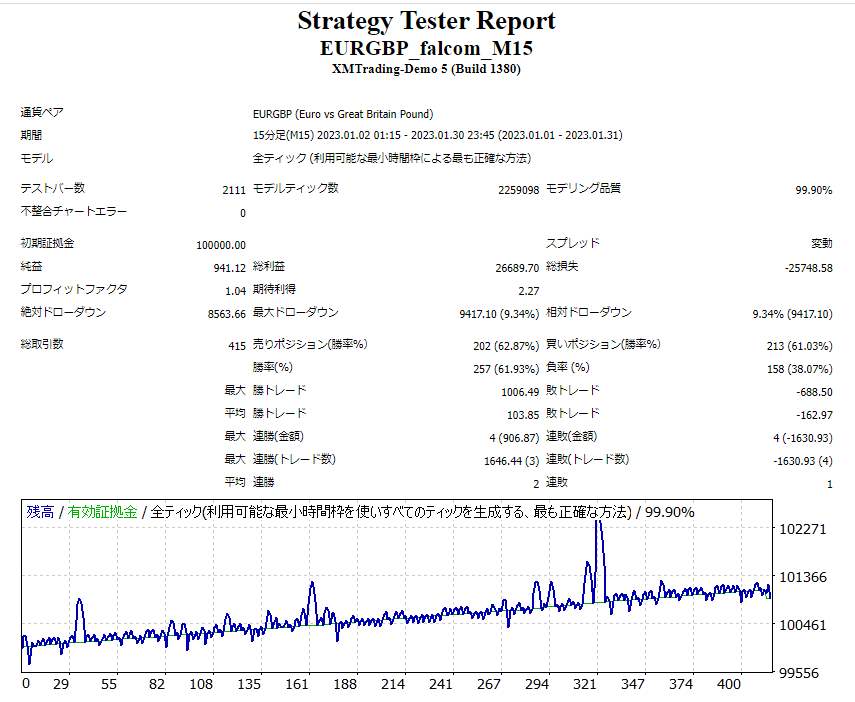

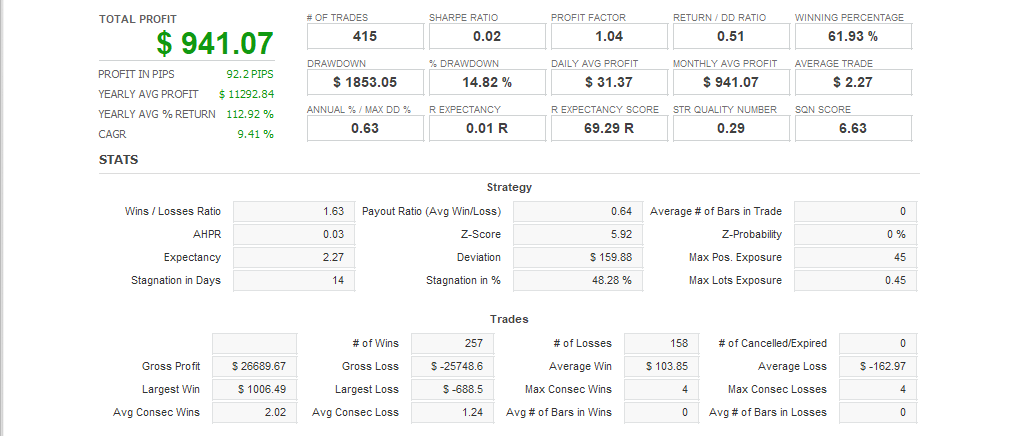

EURGBP_falcon_M15 is a hedging strategy focused on EURGBP. It can be used on 15-minute timeframes. The value of this EA lies in the rarity of the EURGBP currency pair and the hedging strategy used.

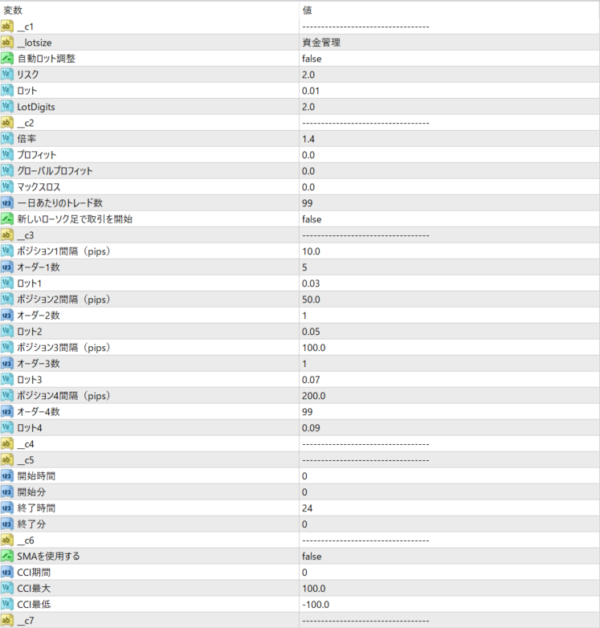

- fund management

- Auto Lot Adjustment : If this option is enabled, the EA will auto adjust the trading lot size based on the risk. If disabled, you can set the lot size manually.

- Risk : Specify the percentage you want to risk on the trade. For example, if you want to risk 2% of your funds, set this to 2.

- Lot : The trading lot size when manually set. For example, 0.01 means that the trading size per lot is 0.01.

- LotDigits : Specifies the number of decimal places for the lot size. Usually, 2 digits is the most common.

Trading Setup

- Multiplier : Specifies the multiplier for adjusting the lot size for the next trade when profit is achieved. For example, if you set it to 1.4, the next trade will use 1.4 times the current lot size.

- Profit : Closes the trade when profit reaches or exceeds the specified value. Set to 0 to disable.

- Global Profit : Closes the trade when the overall profit reaches or exceeds the specified value. Set to 0 to disable.

- Max Loss : Closes the trade if the loss reaches or exceeds the specified value. Set to 0 to disable.

- Number of trades per day : Sets the maximum number of trades allowed per day.

- Open a trade at a new candlestick : Specifies whether to open a trade at the beginning of each new candlestick.

Position Settings

- Position 1:

- Position 1 Interval (pips) : Specify the position 1 interval.

- Number of orders per position : Specifies the number of orders to open simultaneously in position 1.

- Lot 1 : Specifies the trading lot size for position 1.

- Position 2:

- Position 2 Interval (pips) : Specify the position 2 interval.

- Number of Orders 2 : Specifies the number of orders to open simultaneously for position 2.

- Lot 2 : Specifies the trading lot size for position 2.

- Position 3:

- Position 3 Interval (pips) : Specify the position 3 interval.

- Number of Orders 3 : Specifies the number of orders to open simultaneously at position 3.

- Lot 3 : Specifies the trading lot size for position 3.

- Position 4:

- Position 4 Interval (pips) : Specify the position 4 interval.

- Number of Orders 4 : Specifies the number of orders to open simultaneously at position 4.

- Lot 4 : Specifies the trading lot size for position 4.

Other Settings

- Start and End Times : Specify the time period when trading will begin and end.

- Use SMA : Specifies whether to use the SMA (Simple Moving Average). If enabled, the SMA will be used instead of the CCI.

- CCI Period : Specifies the calculation period for the CCI (Commodity Channel Index).

- CCI Max and CCI Min : Enter a trade when the CCI value falls within these ranges.