Features of Monte Carlo EA

The Monte Carlo EA has a mechanism to recover losses by increasing the lot size in the next trade if the previous trade is lost. The new version is designed to effectively recover losses from multiple trades. This function allows for more flexible capital management and allows you to trade with reduced risk.

Entry conditions

Entry conditions are set using multiple technical indicators, and we are careful not to rely too heavily on any particular indicator. This improves the accuracy of trades and allows us to respond to various market conditions.

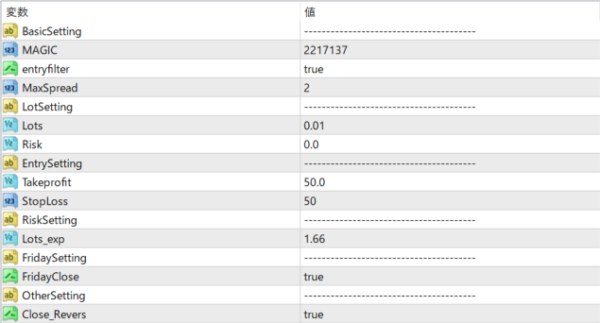

About parameters

-

MAGIC :

-

Description : A number to identify this EA's trades. Set a unique value to avoid confusion with other EAs or manual trades.

-

-

Carefully Selected Entry Mode (entryfilter) :

-

Description : If set to true, the entry conditions will be stricter. This will reduce wasteful trades and aim for a higher win rate.

-

-

Maximum allowed spread (MaxSpread) :

-

Description : Specify the maximum spread when trading. If the spread exceeds this value, trading will not be performed. The setting value is usually recommended to be within 2 pips.

-

2. Lot setting

-

Number of lots :

-

Description : Sets the number of lots to be used in trading. The default setting is 0.01 lots. Adjust it to suit your own money management.

-

-

Risk Setting (Risk) :

-

Description : The setting used for compound interest calculation. If it is 0, you will trade with a fixed lot. If you want to trade with risk, set it to an appropriate value.

-

3. Entry Settings

-

Takeprofit :

-

Description : The number of pips to lock in profits. The default is 50 pips. Set it appropriately so you don't miss out on profits.

-

-

StopLoss :

-

Description : Number of pips to limit your losses. Default is 50 pips, very important for risk management.

-

4. Risk Management Settings

-

Lot multiplier (Lots_exp) :

-

Description : When a loss occurs, the lot size for the next trade can be increased by this factor. This is an important setting for aiming for a recovery.

-

5. Position Settings

-

Maximum number of positions (MaxOrders) :

-

Description : The maximum number of positions that can be held at the same time. The default is 2. Setting this allows you to diversify your risk.

-

6. Friday trade setups

-

Friday Close :

-

Description : Sets whether to stop trading after a certain time on Fridays, which can help reduce risk ahead of the weekend.

-

-

Trading Stop Time (Stop_Time_Friday) :

-

Description : Sets the time to stop trading on Fridays. Default is 20:00.

-

-

Close Time (Close_Time_Friday) :

-

Description : Time to close trading on Friday. Default is 22:30.

-

7. Other Settings

-

Closing on signal reversal (Close_Revers) :

-

Description : Whether to close existing positions when the signal reverses. Please consider this as part of your risk management.

-

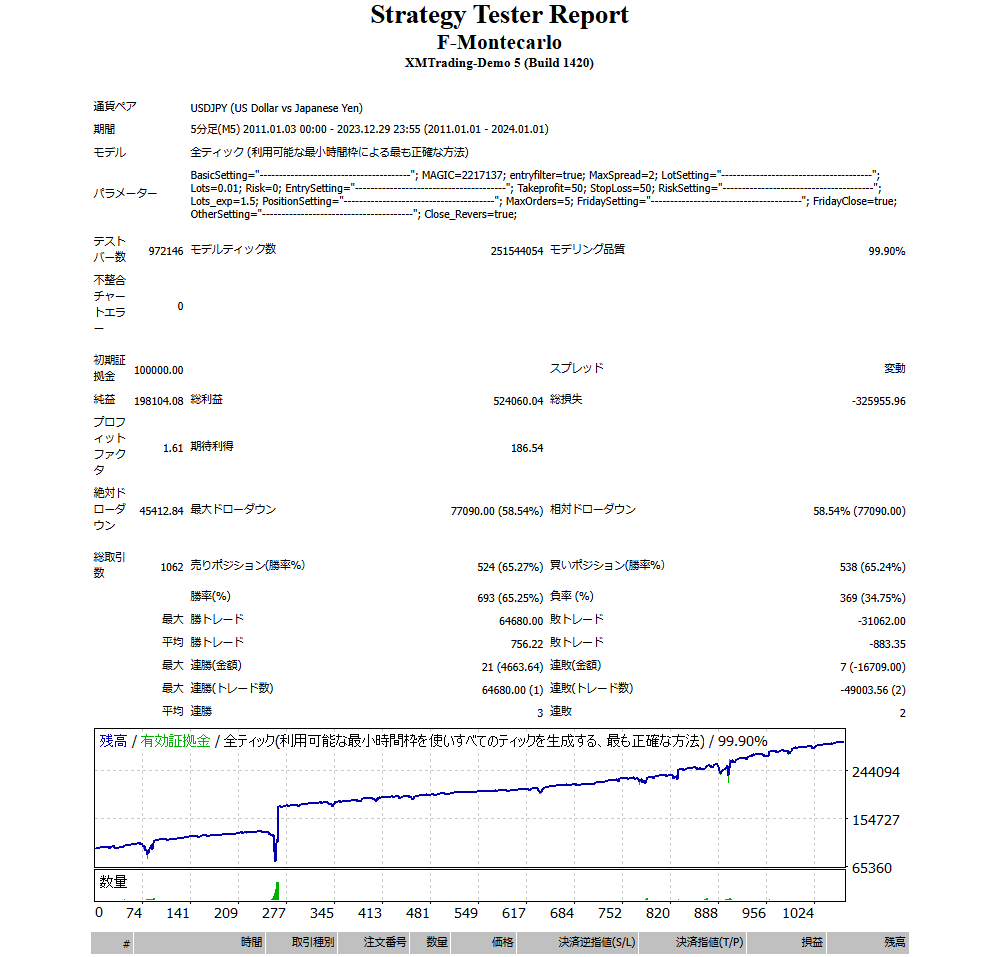

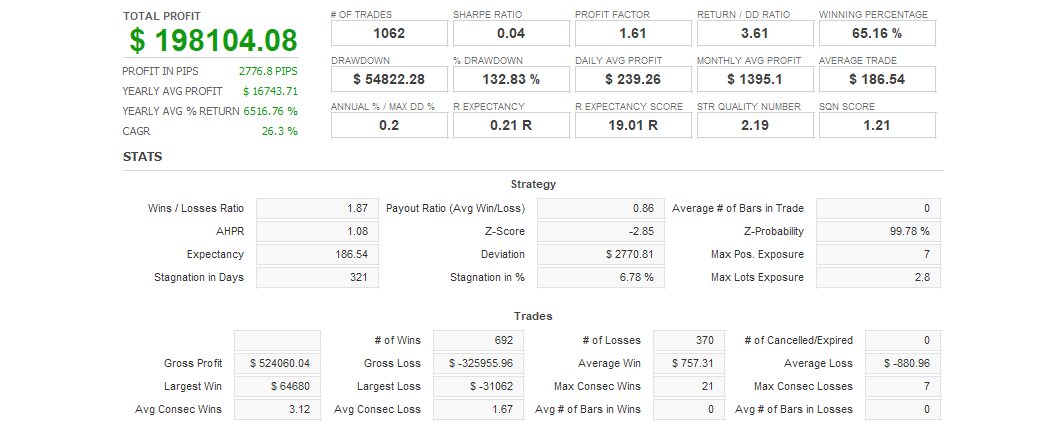

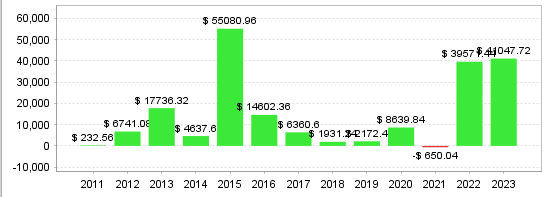

The results are very good!

In actual testing, the Monte Carlo EA has achieved excellent results.

Other Currency Pairs

AUDUSD

EURGBP

EURUSD