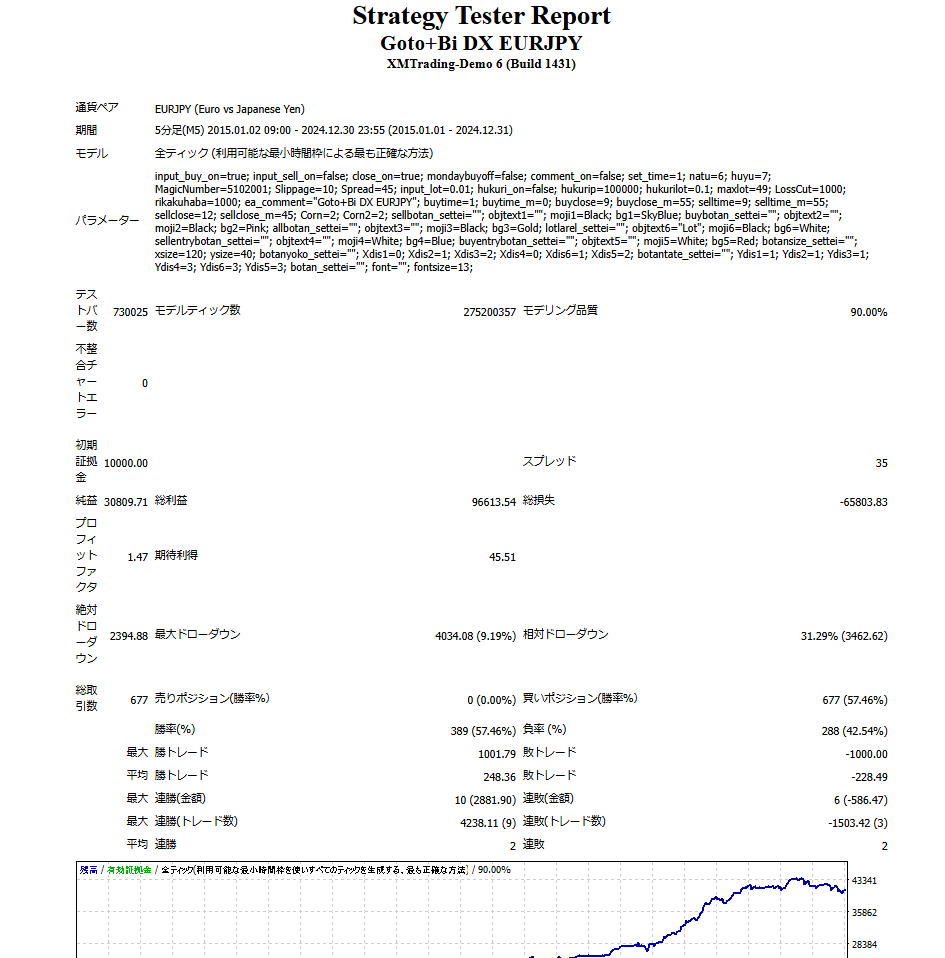

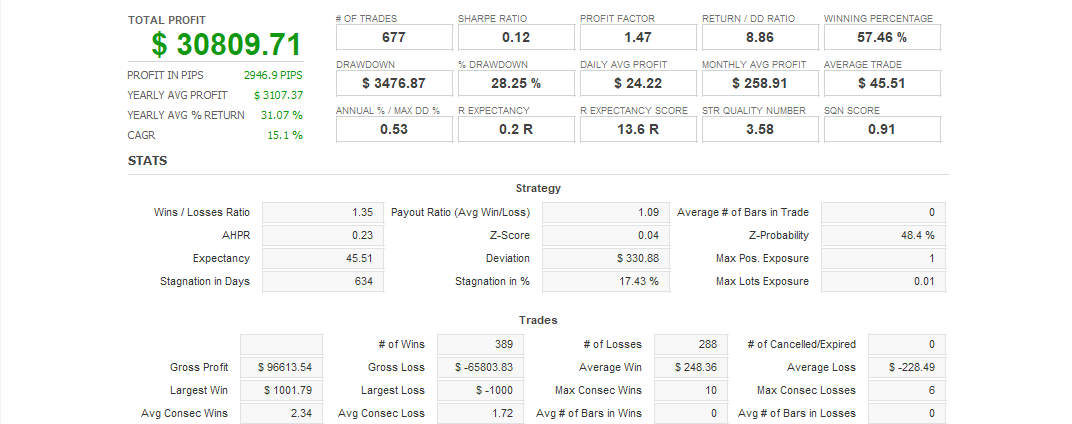

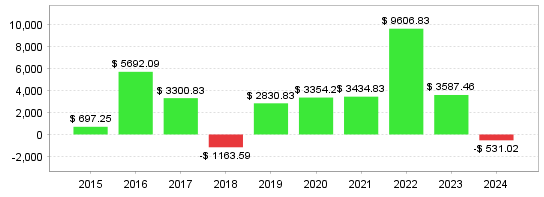

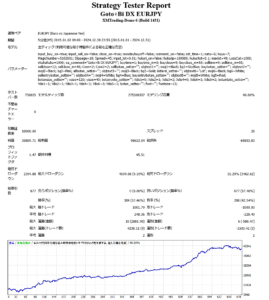

[EA Overview] – A simple Gotoh day mid-price anomaly EA that enters and settles at a set time. – Default parameters are set to match EURJPY. – There are many parameter settings, so you can customize to your preferences. [Default setting logic] A buy entry is made at 1am on a Gotoh day and settled at 9:55am. If a Gotoh day falls on a weekend, the entry is made on the previous Friday. On a Gotoh day that falls on a Monday, a buy entry is made when the FX market opens between 6am and 7am Japan time. No entries are made during the New Year's holiday period from December 25th to January 4th. [Recommended settings] ・Currency pair: EURJPY ・Time frame: M5 ・Minimum margin and lot size <For fixed lot size> Standard account: 0.01 lot for 10,000 yen Micro account: 0.01 lot for 100 yen <For compound lot size> Standard account: 0.1 lot for 100,000 yen Micro account: 0.1 lot for 1,000 yen [Backtest results for fixed lot size] Margin: 10,000 yen, fixed lot size: 0.01 lot Backtest results for 10 years from January 2015 to the end of 2024  ¥10,000 in 10 years → Approximately ¥40,000! [Backtest results for compound interest lot size] Margin ¥100,000, compound interest lot size 0.1 lot start Backtest results for 10 years from January 2015 to the end of 2024

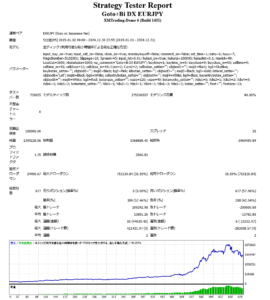

¥10,000 in 10 years → Approximately ¥40,000! [Backtest results for compound interest lot size] Margin ¥100,000, compound interest lot size 0.1 lot start Backtest results for 10 years from January 2015 to the end of 2024  100,000 yen in 10 years → Approximately 1,499,000 yen! [PDF file] ↓ Backtest results of GotoBiDXeurjpy Parameter explanation of GotoBiDXeurjpy How to use GotoBiDXeurjpy

100,000 yen in 10 years → Approximately 1,499,000 yen! [PDF file] ↓ Backtest results of GotoBiDXeurjpy Parameter explanation of GotoBiDXeurjpy How to use GotoBiDXeurjpy

Total Profit

1,351