EA Description

This is something I always keep in mind when developing, not just this EA, but I believe that even if you fiddle around with a lot of strange indicators and improve the superficial BT performance, it will not work at all in real life . I aim to develop EAs that are based only on simple logic whose basis I can understand in my own head.

This EA constantly monitors for signs of a trend and aims for a large price range from the initial movement when a trend occurs.

The most common types of EAs sold in the market are those that determine trends on long-term time frames, enter when the short-term frame reverses, and close with a relatively wide SL and narrow TP width. These types are relatively easy to create and often show good backtesting, but because they wait until the most lucrative market candles appear before entering, they have a poor risk-reward ratio and are based on a high win rate, so when market volatility becomes volatile, you may see your steadily accumulated profits wiped out in just a few trades.

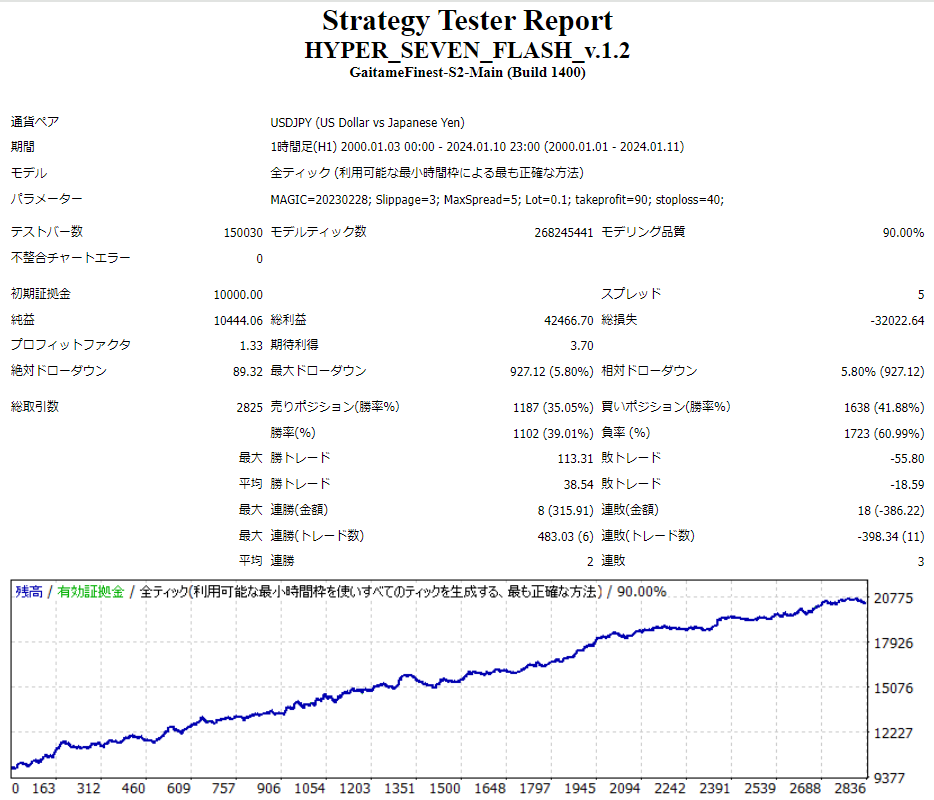

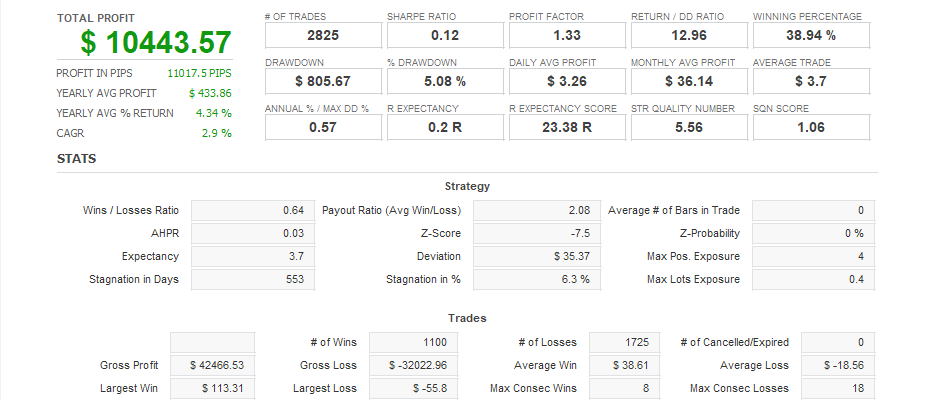

This EA enters the market the moment it detects a trend when it occurs, and if it determines that it has misread the market, it gracefully withdraws and waits for the next big wave.Although the win rate is less than 40%, if you keep running it, the logic is such that profits will eventually swallow up losses, and the EA has continued to reach new highs for over 23 years since 1999.

In addition, because the expected profit is nearly 4 pips, even if the advantage decreases due to a slight generalization of the logic, there is little chance of it falling into negative territory, and it is designed to make profits without using a broker with an extremely low spread.

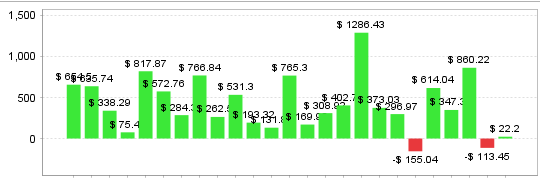

Past performance analysis

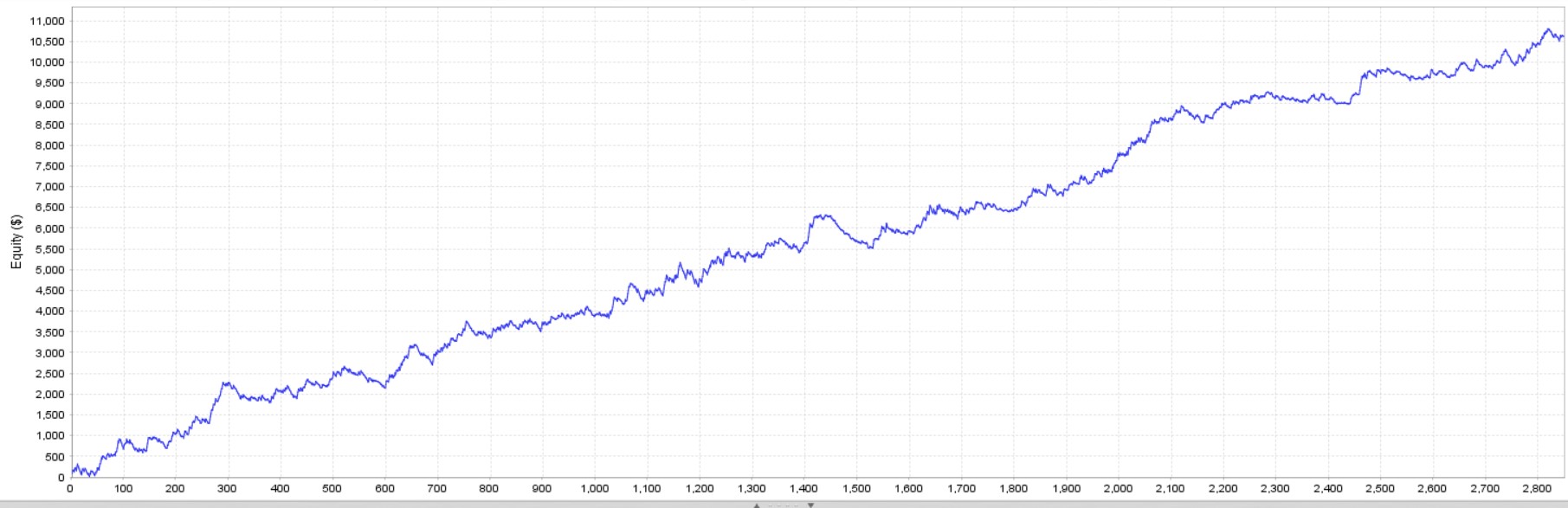

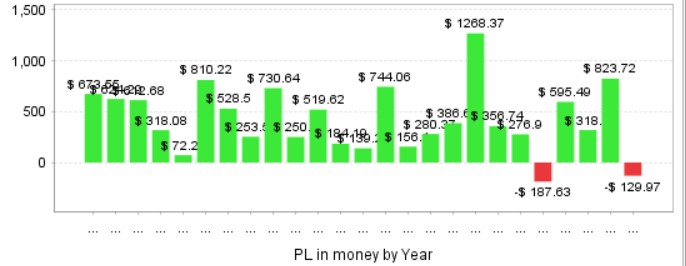

In backtests dating back to 1999, with the exception of one year in 2019, when volatility was abnormally low, the trade has been winning every year, and there has been no significant drop in performance in the recent AI market, resulting in a well-balanced slope of the profit/loss curve.

Also, since there are an average of 120 trades per year, you will not end up in a situation where you buy but never enter the market.

*In order to minimize discrepancies with the backtest, entries will not be made between 0:00 and 2:00 when spreads may be widening.