JpyBreak MT5

"JpyBreak" is an EA that uses advanced logic that combines multiple conditions to target a breakout in the yen market and maximize profits.

¥0 – ¥18,000

✅ Added to cart!

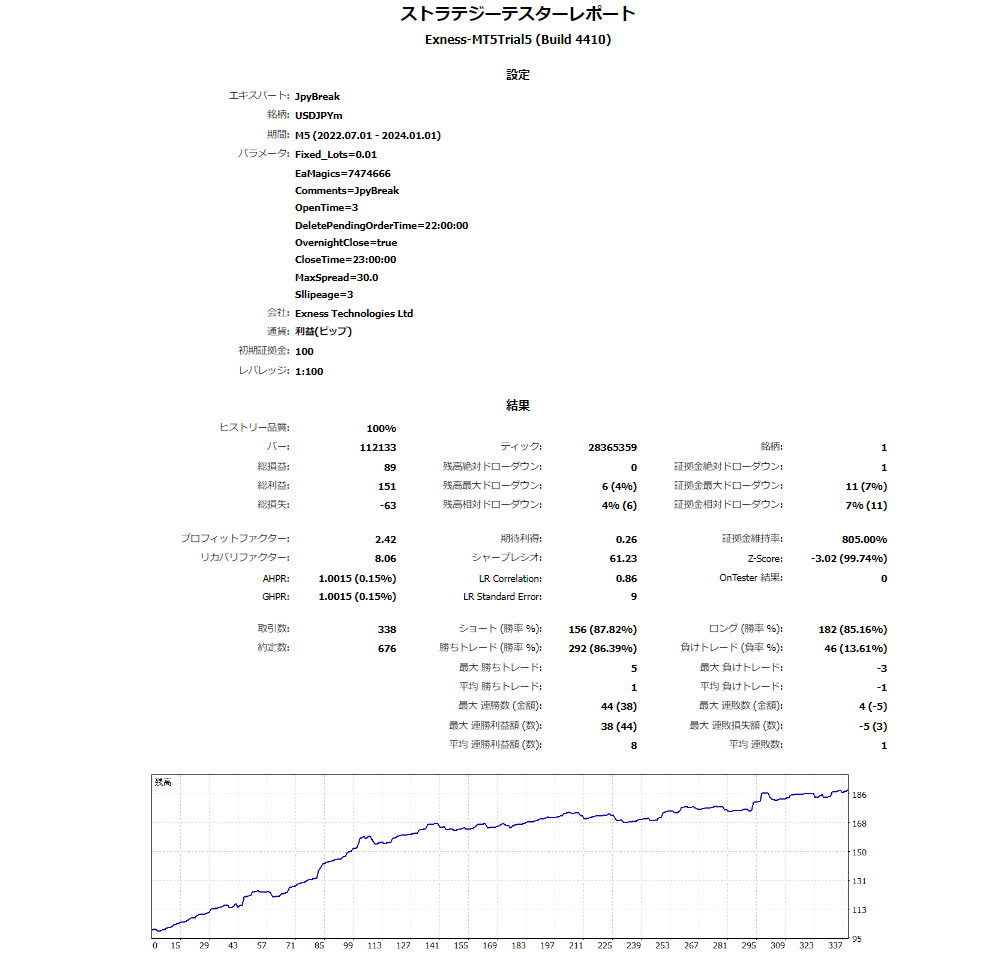

EA Performance Analysis

Win Rate

87.00%

Currency Pair

USDJPY

Trade Type

Swing

Timeframe

5

Max Positions

1 Positions

Max Stop Loss

60

Martingale

No

Hedge

Notes

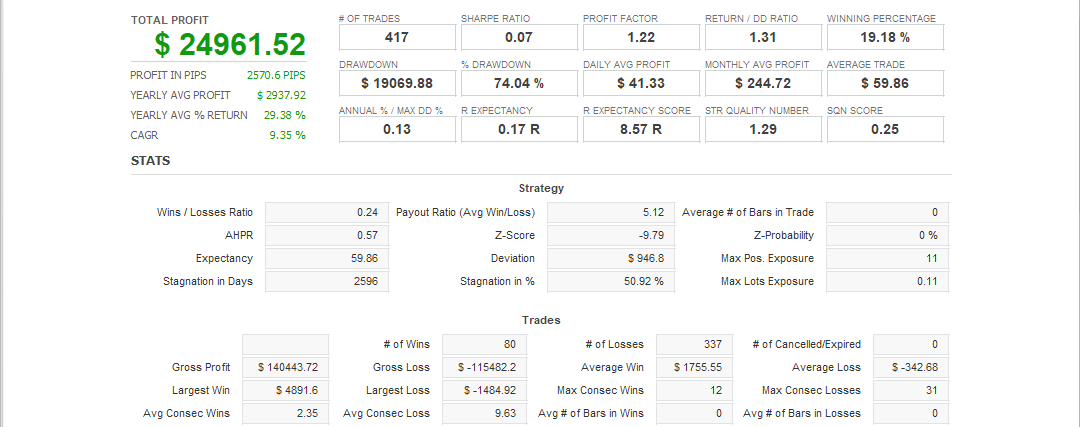

フォワードテスト

Total Profit

1671

Total Trades

182

Win Rate

90.66% (165/182)

PF

1.55

Avg. Hold Time

451.47 分

Max Hold Time

17297 分

Expected Value

9

Monthly Avg Trades

15.92

| Close Time | Type | Open Price | Close Price | Symbol | Hold Time | Lot Size | Profit/Loss |

|---|

Buy vs Sell Trade Ratio

Buy vs Sell Profit/Loss

Total Buy Profit/Loss

0

Buy (Long): 0% (Win Rate0%)

0

Buy (Long): 0% (Win Rate0%)

Total Sell Profit/Loss

0

Sell (Short): 100% (Win Rate: 90.66%)

0

Sell (Short): 100% (Win Rate: 90.66%)

Entries by Time of Day

Profit & Loss Calendar

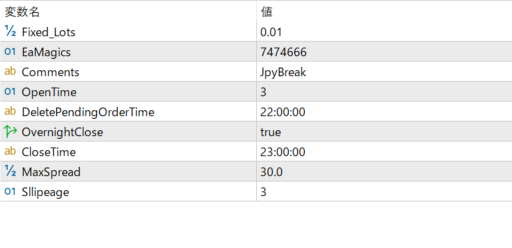

Parameters

Trading Info

Recommended Fund:

$100 USD

$100 USD

Expected Monthly Return:

5%

5%

🛈

This data is based on a 0.01 lot size. Actual performance may vary depending on your lot size.

Entry Condition

It uses signals from moving averages and oscillators to determine entries. A buy or sell position is opened when the price reaches a specified high or low. Entry signals can also be determined by the crossover of two moving averages or the crossover of the Stochastic signal line.

Close Condition

Positions are closed when moving averages cross reversals, stochastics reverse signals, oscillators move in the opposite direction, profit taking occurs, or a specified time is reached.You can also manage your positions by setting trailing stops and breakevens to protect your profits.

Favorable Market

It is effective in trending markets, especially in markets with a clear direction and movement along support and resistance lines. It can also be used to effectively utilize breakouts in range markets.

Unfavorable Market

It is not suitable for volatile market conditions that fluctuate rapidly in a short period of time or sudden market movements that are difficult to predict. Careful operation is required, especially when indicators are announced or major news affects the market.

Avoid Trading Timing

Avoid taking large positions around certain economic releases or late on Fridays.

Recommended Operation

It operates at times of high market liquidity, enabling it to produce stable results.

バックテスト

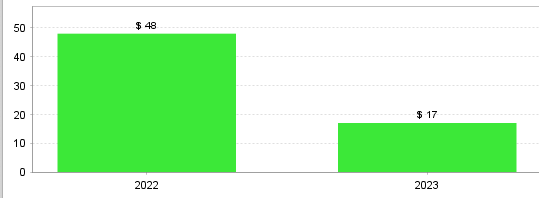

年別取引データ

×

![]()