🎯 "Reconstructing the 'key points' of discretion with logic and precision"

A select-type scalping EA that uses 10 logics to target only the "moments when you can win."

🔧 EA Overview|Precision_Grid_AUDCAD_M30

This EA is a "select-type scalping EA" that allows users to select and operate up to 10 independent logics. Target currency: AUDCAD Time frame: M30 (30-minute chart) Expected style: Short-term scalp + nanpin-type recovery

✨Feature Pickup:

– "Signal-distributed division of labor" structure using multiple logics – Operates with simple interest and fixed lots (no marting) – Individual on/off and maximum position control possible for logics – "Currency-distributed complementary" structure with seven Precision/Core series further enhances stability. By combining "logic groups that are close to the perspective of discretionary traders" with "mechanical entry management," it enables smart operation with high precision, low frequency, and short-term settlement. Furthermore, this EA is part of a series consisting of seven Precision (M30) and CoreLogic (M15) series, and is designed to reduce time-axis and logic conflicts between entries in each currency (AUDCAD/AUDNZD/NZDCAD/USDCAD).

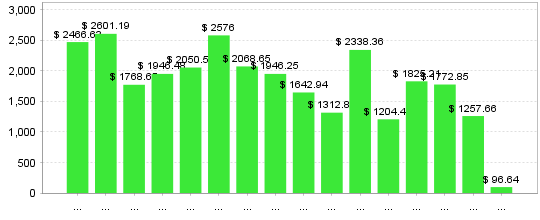

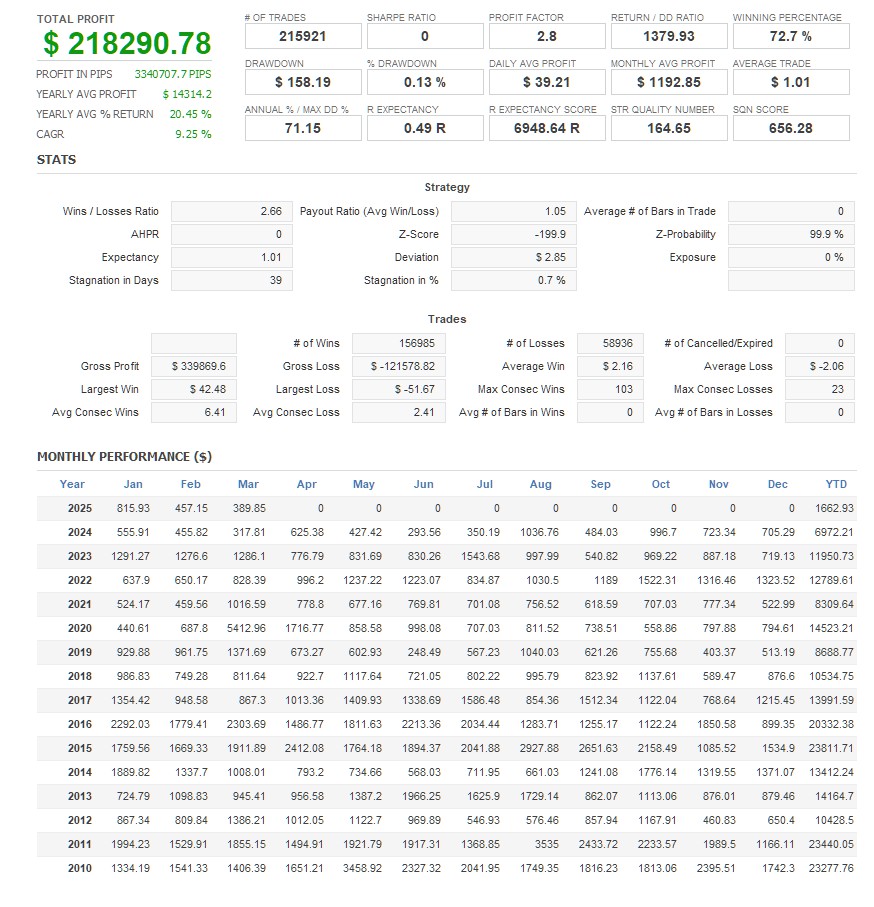

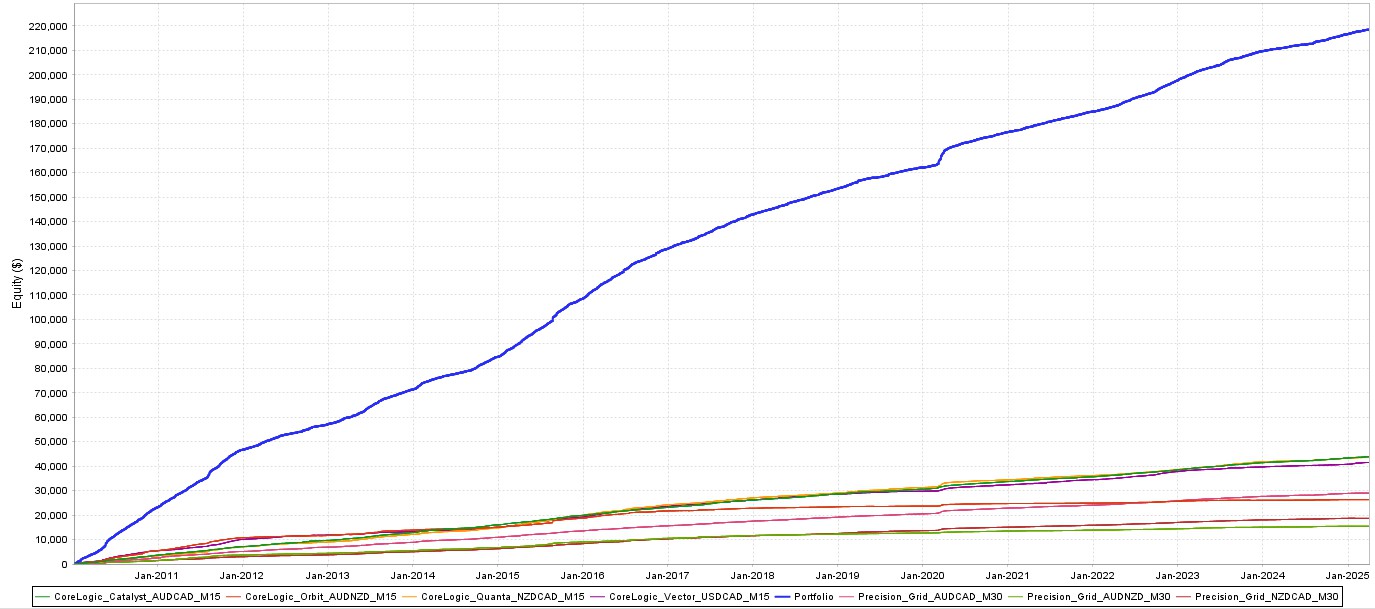

📊 By using all 7 strategies together, **the timing to win will be mutually complementary, and daily profit opportunities will steadily accumulate**.

▶ You can check out each EA here:

https://sys-tre.com/shop/precision_grid_audcad_m30/ https://sys-tre.com/shop/precision_grid_audnzd_m30/ https://sys-tre.com/shop/precision_grid_nzdcad_m30/ https://sys-tre.com/shop/corelogic_catalyst_audcad_m15/ https://sys-tre.com/shop/corelogic_orbit_audnzd_m15/ https://sys-tre.com/shop/corelogic_quanta_nzdcad_m15/ https://sys-tre.com/shop/corelogic_vector_usdcad_m15/

📈 Forward performance (Myfxbook)

▶︎ Actual real-time results are now available! Myfxbook link

▶▶[Please see below for an image of distributed operation across the entire series]

📊 Overwhelming resilience demonstrated by 15 years of experience

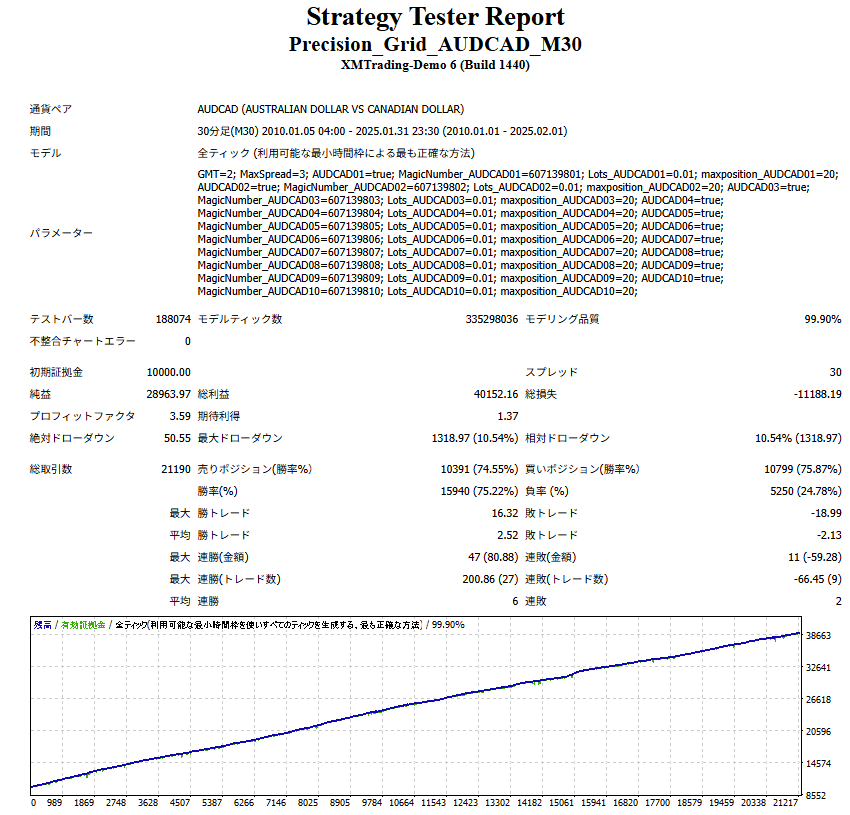

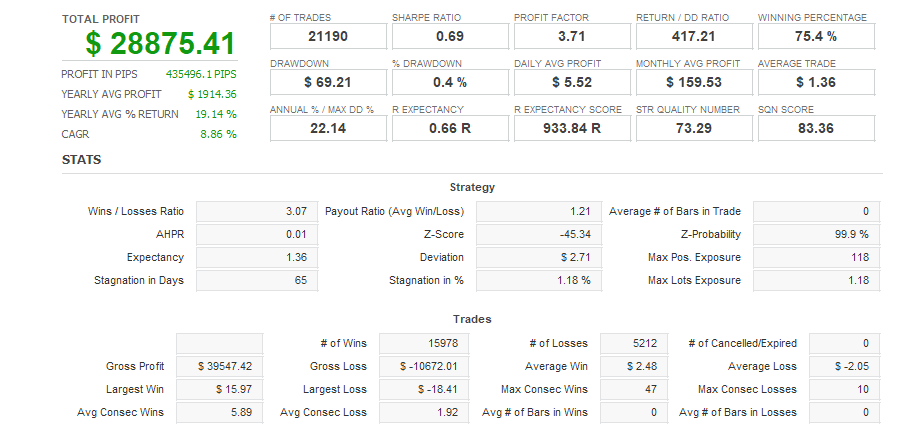

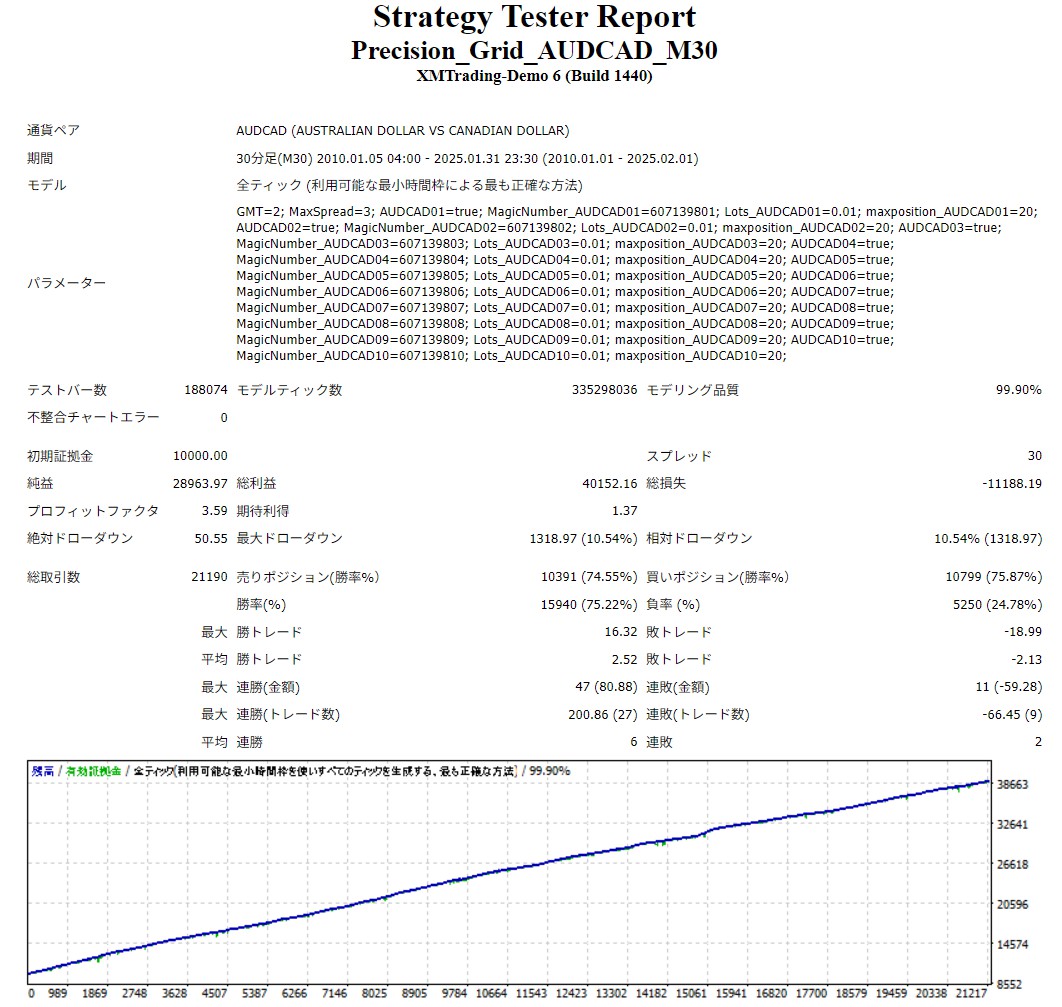

🧪 Understanding the backtest results──Precision_Grid_AUDCAD_M30's "reliable performance"

This EA has recorded extremely balanced results with a profit factor of 3.59, a win rate of over 75%, and a maximum drawdown of 10.5% over approximately 15 years of AUDCAD (M30) data from 2010 to 2025. The following three points are particularly noteworthy:

✅ 1. Recovery Factor (RF) = 21.96

→ Calculated from net profit of 28,963 / maximum DD of 1,318. It is said that "the higher the RF of an EA, the faster it recovers from unrealized losses and the greater the expected profit per position," and this EA is a typical example. It is free from the "endless DD hell" that is common with averaging-down EAs, and stands out for its structure of building up assets through a series of small unrealized losses → early elimination → small profit taking.

✅ 2. Profit Factor (PF) = 3.59

→ Overall, the profit was 3.6 times the loss, and the overlapping of more than 10 logics allows for flexible response to market fluctuations, proving that the loss prevention algorithm is working.

✅ 3. The denominator strength is 75.2% win rate x 21,190 trades

→ For stable operation, a large number of trials is more important than a high win rate, and this EA has both. It uses 30-minute charts and high-frequency logic to accumulate small winning trades. Even in volatile markets, this EA can generate profits without making large bets.

💡 And more──

・Modeling accuracy is 99.90%, with zero inconsistency errors. ・Loss per lot is extremely small, and automatically adjusted within the range of "nanpinning with position number limit."

📈 Overall Review:

This EA is designed to be chosen by traders who are afraid of averaging down and want to avoid deep DD. It is for those who want a "gradual but steady increase curve."

📚 The "asset management" approach of the nanpinning strategy – The theoretical basis of this EA

This EA employs a "solid nanpinning strategy" that applies three long-standing, standard theories in asset management : dollar cost averaging, value investing, and portfolio management . While many may be wary of the risks inherent in these nanpinning strategies, this EA's approach is not simply nanpinning; it combines multiple investment theories, including the following: First, similar to dollar cost averaging, a well-known method of investment savings, increasing positions when prices fall effectively lowers the average price. This is an extremely rational strategy that automatically buys at low prices and seeks profit opportunities when the market recovers within a certain range. Furthermore, this EA is designed for use with multiple currency pairs. Similar to the fundamental asset management concept of "portfolio diversification," this EA diversifies risk by taking advantage of differences in the price movements of each currency. This avoids unidirectional risk and achieves more stable operations. Furthermore, similar to the concept of "value investing," which aims for future profits by investing when prices are low, this EA offers a solid and practical approach that "turns market distortions into opportunities." Rather than simply averaging down, this EA aims to achieve highly rational management in the medium to long term by combining these multiple investment theories.

🧠 10 strategic logics that shape trader intuition

This EA is equipped with many logics specialized for "rebound-targeting contrarian scalping," and its strengths lie in its comprehensive structure that covers noise removal, reversal accuracy, and trend determination. Among these, the following strategies play a central role.

💡 RSI Cross Type: A precise contrarian logic for cautious traders

→ The logic is to react only when the RSI crosses a specific line twice in a row. It is a contrarian strategy that does not jump in, is not fooled, and assesses the accuracy of the strategy, with a structure that "does not move on the first crossing" and "pick up only genuine rebounds."

💡 Break → Cross type : The logic behind seeing through a false breakthrough.

→ This is a counter-trend logic that targets the movement of the price after penetrating the high/low moving average band and then returning. It requires a cross confirmation after the breakout.

💡 Micro-deviation pinpoint type: Aiming for ultra-short-term reversal by reading a single point

→ Using the moving average x high and low prices x subtle price differences, this logic pinpoints the moment when a price has risen too much or fallen too much. It is a sniper-style contrarian strategy that bets on an immediate rebound.

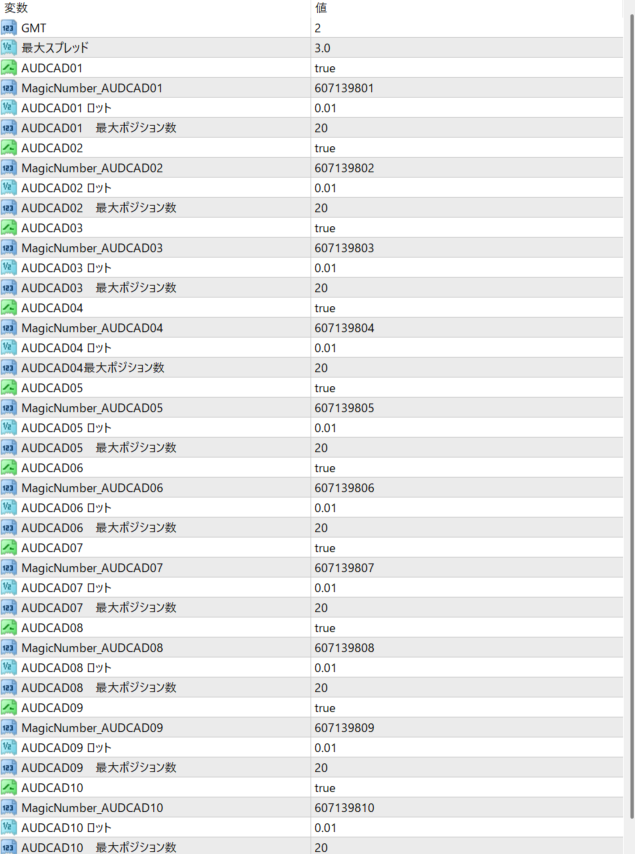

🔧 Easy to operate and flexible adjustments

This EA allows users to adjust the following items as desired. Even without detailed optimization, the default settings provide sufficiently stable operation. ・Lot count: Can be set for each logic (default: 0.01) ・Maximum number of positions: Controlled up to 20 positions per logic ・Magic number: Automatically assigns a unique identification number to each strategy ・Strategy ON/OFF switching: 10 strategies can be individually enabled/disabled

⚙ Risk management is also designed in.

・No infinite nanpinning ・Maximum number of positions limited

📘 What about Null Store EA? ──Precisely designed "Discretionary Thinking EA Group"

This brand aims to implement "a market view like a discretionary trader" into EA. It is precisely designed so that each entry is made at a "reasonable timing." The Precision_Grid series is structured so that the initial entry is made with high-precision logic aimed at single-shot scalping, and then gradually averaging down depending on market conditions.

⚙ Series composition:

M30: Precision_Grid series AUDCAD/AUDNZD/NZDCAD M15: CoreLogic series AUDCAD/AUDNZD/NZDCAD/USDCAD The averaging down strategy involves a certain amount of risk, but Null Store's EA is designed to avoid excessive risk concentration by using a "filter design to reduce wasted shots" and "distributed logic to prevent simultaneous activation."

👉 Other EAs here

https://sys-tre.com/shop/precision_grid_audcad_m30/ https://sys-tre.com/shop/precision_grid_audnzd_m30/ https://sys-tre.com/shop/precision_grid_nzdcad_m30/ https://sys-tre.com/shop/corelogic_catalyst_audcad_m15/ https://sys-tre.com/shop/corelogic_orbit_audnzd_m15/ https://sys-tre.com/shop/corelogic_quanta_nzdcad_m15/ https://sys-tre.com/shop/corelogic_vector_usdcad_m15/

⚠ Please be sure to check before use

・This EA is based on past market data. ・It does not guarantee future profits. ・Please use this EA at your own discretion.