■■ 🎯 The key to discretion is perfectly reproduced in EA. ■■

Introducing the "10 logic selectable day trading EA" that targets only the core of the market. This EA is a "selectable day trading EA" that allows users to select and run up to 10 independent logics.

🔍 Three core functions that support operations

・"Signal decentralized division of labor structure" using multiple logics ・Operates with fixed lots (no marting) ・Can also control individual logic on/off and maximum position size → By combining multiple logics to your liking, you can create "your own automated trading" that suits the market and your lifestyle. By combining "logic groups that are close to the perspective of discretionary traders" with "mechanical entry management" — it enables smart operation with high precision, low frequency, and short-term settlement.

🔧 Logic design based on "real-world specifications" without over-optimization

[01 | Design Philosophy] This EA is purposefully designed with minimal adjustments, avoiding excessive parameter optimization. Its structure demonstrates its strengths in actual operation, rather than based on temporary past market performance. [02 | Reproducibility and Stability] There is little discrepancy between backtest and forward performance, and it flexibly responds to market changes. It stands out from "paper-thin EAs" that only perform well in backtests. [03 | Suitable for] ✔ Those who value actual usability over backtest numbers ✔ Those seeking "solid logic" that can withstand long-term operation ✔ Those looking for an EA that can be used reliably even with the default settings. Please try out this EA that will win by its very nature.

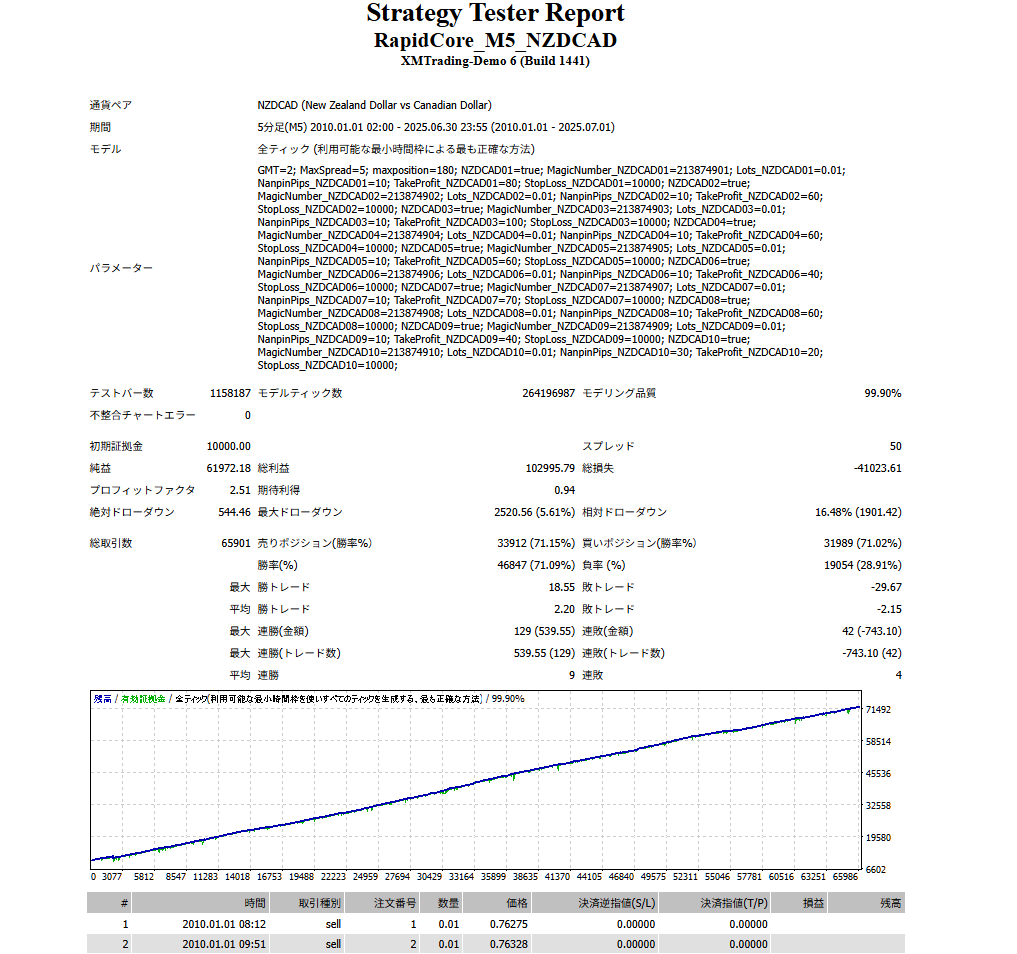

📊 "Practical logic" proven by long-term variance and statistical reliability

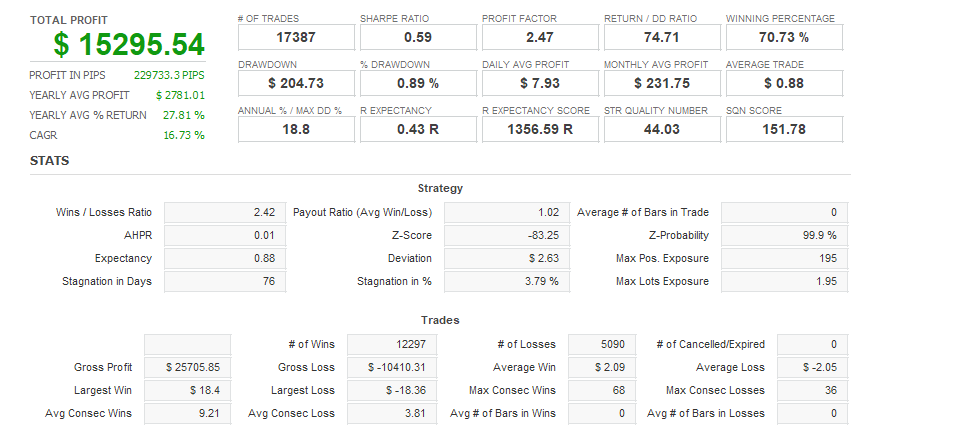

Based on approximately 15 years of historical data from 2010 to 2025, this EA has achieved high levels of performance in terms of number of trades, win rate, and profit/loss efficiency. [Four achievements supporting its statistical strength] ✅ Recovery Factor (RF): 24.5 → Achieves resilience by efficiently accumulating profits while minimizing losses. ✅ Profit Factor (PF): 2.51 → A good balance between winning and losing trades, proving the logic is highly stable. ✅ Win Rate: 71.09% → Stable entry accuracy supports continuous profit generation. ✅ Total Number of Trades: 65,901 → A sufficient testing population ensures high levels of statistical reliability and reproducibility.

📊 "Realistic strength" for long-term operation

This EA is not just about pursuing a performance index optimized for past data, but is designed to be a "real logic" that can be used stably over the long term. Backtesting has confirmed its reliability in terms of the number of trades, stability, and profit/loss balance, all of which are directly linked to actual operation. This is an EA that should be of interest to those seeking logic that reproducibility, not superficial results. We recommend it to those looking for an EA that "delivers results in real-world situations, not just looks."

📚 The "asset management" approach of the nanpinning strategy – A solid design supported by theory

This EA employs a sound averaging strategy that applies fundamental asset management theories, such as dollar cost averaging, portfolio management, and value investing, rather than simply averaging down. By gradually increasing purchases when prices fall, the average purchase price is lowered, and profits are targeted when prices rebound. This rational approach is widely used in installment investments. Furthermore, diversifying across multiple currency pairs avoids concentrated risk in one direction. This investment style mechanically captures market distortions and steadily builds up profits. This EA is part of a portfolio strategy comprised of four currency pairs. By further enhancing the diversification effect across multiple currencies, this strategy aims for a more stable asset curve. By managing the entire series, you can further refine your EA-based asset management. *For details on the series structure and other EAs, please see the related links below. RapidCore_M5_AUDCAD RapidCore_M5_AUDNZD RapidCore_M5_NZDCAD RapidCore_M5_USDCAD "A strategy backed by investment theory and suitable for long-term operation" — that is the core of this EA.

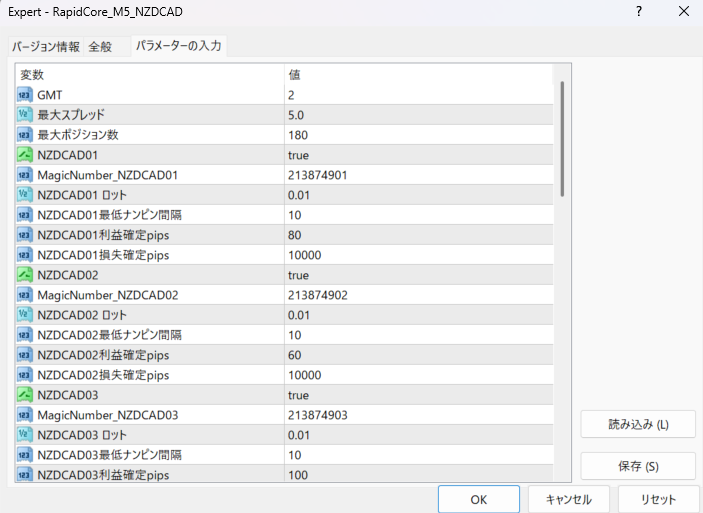

▼🔧 Easy to operate. Freely adjustable.

This EA allows users to adjust the following items as desired. Even without detailed optimization, it achieves stable operation with the default settings. ・Maximum number of positions limited ・Lot size: Can be set for each logic (default: 0.01) ・Magic number: Automatically assigns a unique identification number to each strategy ・Strategy ON/OFF switching: Multiple strategies can be enabled/disabled individually ⚙ Risk management is also designed in ・Infinite averaging is not performed ・Maximum number of positions limited

📘 What is Null Store? ──An EA specialty brand that wins with discretion and precision design

★ Null Store's EAs are a brand designed to incorporate a "discretionary trader's market perspective" into EAs. Each entry is meticulously designed to occur at a "reasonable timing." ⚠ Please be sure to check the following before use (*For peace of mind) ・This EA is based on past market data ・It does not guarantee future profits ・Use at your own discretion and responsibility *This EA does not perform infinite averaging-up, but instead has a maximum position limit and a diversified design. Numerous features are incorporated to ensure safe use. Start with a small amount and small lot to experience how the logic works.