-

- Features of EA

This EA follows the trend on the day when Japanese companies are expected to settle. I myself have been using this type of EA from other authors, but due to the recent one-sided depreciation of the yen, my performance has deteriorated, so I developed this to improve my own portfolio.

So I reconsidered the essence of mid-price trading and decided to create my own EA.

Since this is an EA that will manage your valuable funds, we have tried to explain the logic as much as possible, rather than making it a black box.

Please understand this before purchasing.

Let's start with the conclusion

To get straight to the conclusion, when we set the conditions in detail and tested it, we found that the USD/JPY showed characteristic price movements around the mid-price time, and this EA targets the following days.

①Goto Day

②End of the month

About Short Logic

Entry time is 9:55 and exit will be settled before 14:00.

If you first mechanically short at 9:55 every day, you will get the following results.

Even taking into account the 1.0 pip spread, I am still winning, but it feels like a very close call.

However, if we narrow it down to Goto Day,

The results will be quite stable.

Next is the end of the month (after the 23rd of each month).

This is the result of shorting on a normal day excluding these conditions. (Except for Gotoh days, the end of the month, and Fridays)

(Fridays also tend to favor short positions, but the advantage is small, so we do not use them.)

I realized that shorting on any day other than Gotoh days, the end of the month, or Friday would only result in losses.

I myself have suffered significant losses using a commercially available mid-price EA,

It is extremely regretful to think that if I had started creating my own EA earlier, I could have avoided significant losses.

About Long Logic

For many commercially available EAs, long entries will be made from 9:30 a.m. on Goto days towards the mid-price time.

However, since there is only 24 minutes from entry to settlement, it is difficult to take advantage of the price range, and if the spread becomes 1.0 pips, you will already lose. This shows that it is difficult to make a profit unless you use a broker that offers very favorable spreads.

To improve this weakness, I found that I could overcome it by setting up a long position in advance during the calm hours after the intense trading during New York time.

What can be inferred from the above?

Based on the above verification results, it is predicted that the following real demand money flow will continue for many years.

Goto Day → Dollar buying demand (strong) From midnight to the mid-day, the demand for foreign currency increases, and dollars are bought. After the mid-day, the demand returns to the original level, causing the dollar to weaken relatively.

Friday → There is a tendency for the price movements to be the same as above, but not as strong as on Goto Day.

End of the month → There is no demand for buying dollars, but the yen tends to appreciate in the morning. (It is expected that companies are converting foreign currency into yen to pay employee salaries and other payments at the end of the month.)

The logic of my own EA is as follows:

Long at midnight on the day before Goto Day, short at mid-price on Goto Day, short at mid-price on the month end

Furthermore, for short positions, performance was further improved by incorporating logic to avoid entry when the chart was in an unfavorable position in the absence of dollar buying demand.

Z

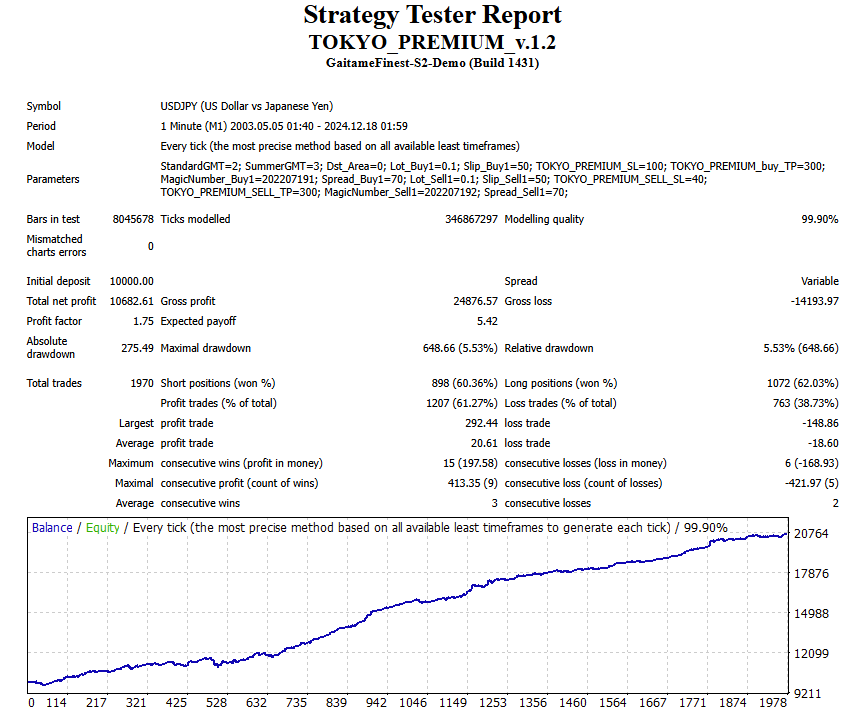

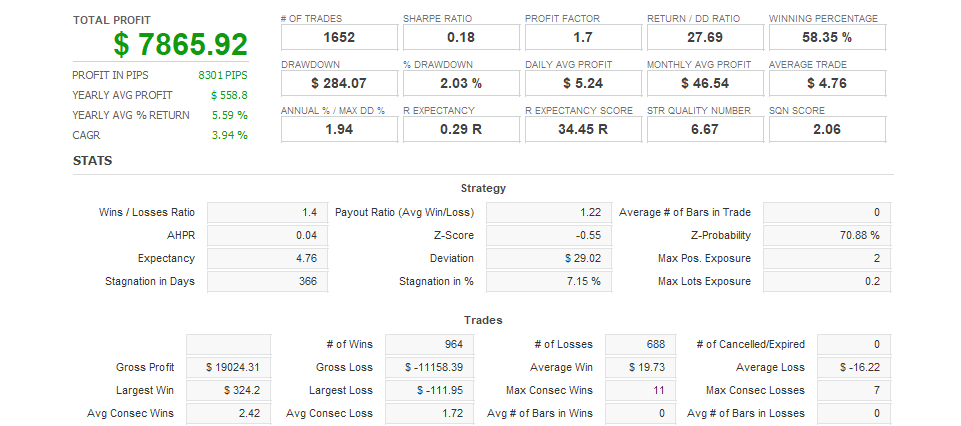

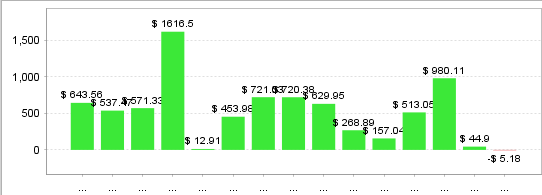

The profit and loss curve has been transformed into a super high performance EA with a PF of 1.6 or more even with a 1 pip spread, a RET/DD of around 20, and an expected profit of 4.2 pips.

We are absolutely confident in our logic, so if you are interested, please consider purchasing it.

Total Profit

14,031