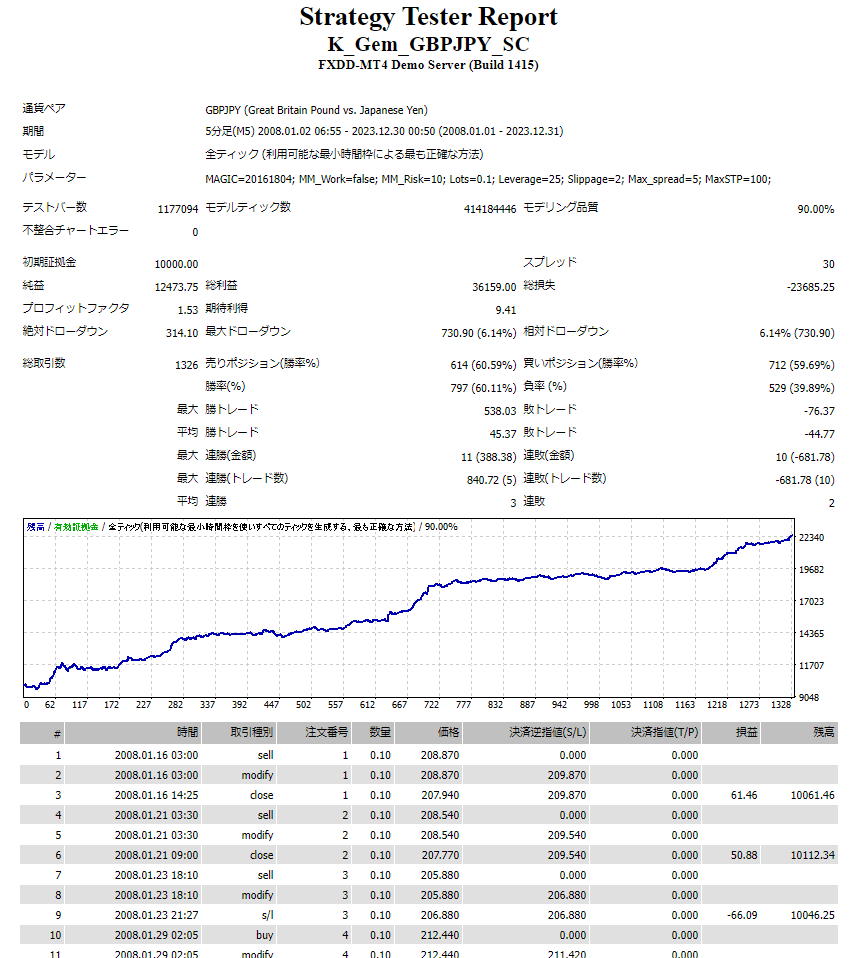

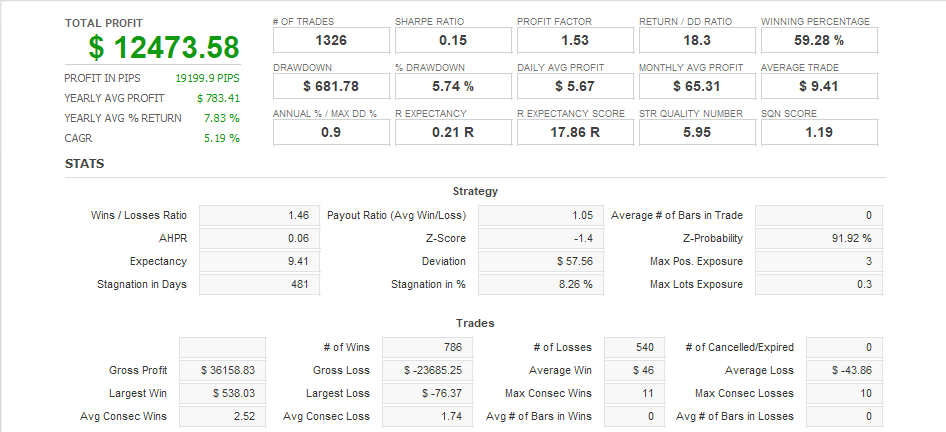

■EA Overview■ K_Gem_GBPJPY_SC is an EA dedicated to the 5-minute GBPJPY chart. However, the main indicator used is the Bollinger band at the 1-hour chart level, and it is designed to enter when the ±2.0σ line of this Bollinger band is expanding, that is, when the so-called expansion state is reached. As many of you may know, an expansion is a shape that occurs at the initial movement of a trend. In other words, by checking the expansion, you can avoid unnecessary entries in a cross-holding, and enter only after the trend has clearly developed. ■EA Features■ ・EA dedicated to the 5-minute GBPJPY chart ・Trend-following EA of day trading type ・Trading between profit and loss ・Rising profit curve in backtests over the past 16 years ・Simple parameter settings These features can be briefly explained as follows: ・EA dedicated to the 5-minute GBPJPY chart K_Gem_GBPJPY_SC is an EA dedicated to the 5-minute GBPJPY chart, so it cannot be used with other currency pairs or time frames.・Trend-following EA for day trading Enter when Bollinger bands are in expansion state at 1-hour chart level and when there is a small pullback or rebound at 5-minute chart level. The average time the position is held is 20 hours so it can be considered a day trading type. However, depending on the market situation, there are cases where the profit taking conditions are not met and the position is not stopped, and the position is kept for about 2 days. ・The stop width for trading during loss and profit changes depending on the volatility of the market. In other words, the stop width is smaller in a low volatility market and wider in a high volatility market. The maximum stop width is defined as 100 PIPS in the parameters, but there are few cases where it is taken that wide, and when looking at past trading data, the stop width is about 70 PIPS. Profit taking also changes depending on the market situation, but rather than pursuing maximum profit, I try to settle the position when a certain profit width is reached. The risk-reward ratio is just over 1, and the win rate is just over 60%, making it a balanced EA. – Backtesting over the past 16 years has shown a rising profit curve. The longer the backtesting period, the more reliable it becomes. Backtesting with this EA has been done over the past 16 years, and it has been able to achieve a rising profit. The past 14 years means that there have been no major drawdowns and profits have continued to be made, even during the Lehman Shock of 2008, the Great East Japan Earthquake of 2011, and the Corona Shock of 2020. – Easy parameter settings This EA has as few parameter items as possible so that even beginners can use it with confidence. You can use it just by entering the minimum required items such as "magic number" and "lot number". ■ Parameter description ■ [MAGIC] = 20161804 (default value) Please set a different value from other EAs. [MM_WORK] = false (default value) Compound interest function on/off. Set to true if you want to use the compound interest function. [MM_Risk]=10.0 (default) Risk tolerance when compound interest is enabled. What percentage of maximum leverage should the lot size be? [Lots]=0.1 (default) Lot size when entering with simple interest. [Leverage]=25.0 (default) Maximum leverage of the securities company. [Slippage]=2 (default) Maximum slippage. If it slips any further, entry will not be made. [Max_spread]=5.0 (default) Maximum spread. If it spreads any further, entry will not be made. [Max_STP]=100 (default) Maximum stop width (PIPS). The stop width changes according to the chart shape, but even at its maximum, it will not exceed the value set here. *Additional explanation Basically, there is no need to change these parameters, but [MAGIC] and [Lots] should be changed as appropriate to suit each individual's situation. *Regarding compound interest, if [MM_Work] is false, entry will be made with the lot size of [Lots]. When [MM_Work] is true, the number of lots is calculated from the excess margin, [MM_Risk], and [Leverage]. Specifically, the number of lots = Leverage * Excess margin / 100000 / Price in account currency * (Risk tolerance / 100) Reference example Leverage = 25 (default value), Risk tolerance = 10.0% (default value), Excess margin = 500,000 yen, GBPJPY price = 150 yen, for a yen account, 25 * 500000 / 100000 / 150 * (10 / 100) = 0.08 lots will be entered. ■ Frequently asked questions ■ Q1: Can I use any broker? A1: If you use MT4 with GMT + 2 (GMT + 3 in daylight saving time), you can use any FX company. Q2: Can I carry over positions on weekends? A2: There is no weekend settlement function, so if you take a position just before the market closes, it may be carried over to the next week. Q3: Is it necessary to set summer time and winter time? A3: No. Q4: Can I run other EAs at the same time on one MT4? A4: Yes. However, if the margin is low and both this EA and other EAs have unrealized losses, they may fall below the margin maintenance rate and be forced to settle. Also, please set a magic number different from that of other EAs. Q5: How many positions will you hold? A5: You can only hold one position at a time. Q6: What are the profit and loss limits? A6: The profit and loss limits will vary depending on the volatility of the market at that time, but on average, both are about 70 PIPS to 80 PIPS. The higher the volatility, the larger the profit and loss limits will be. Q7: Can I manually settle my positions? A7: Yes. Q8: Do you do hedging? A8: No, I don't. Q9: How often do you enter the market? A9: Based on backtests and real trades, I enter the market about 8 times a month.

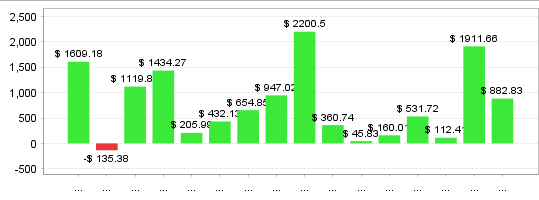

Total Profit

-2,479